The Future of AI in Investment Management: Ethical Considerations and Challenges

Ethical Implications of Algorithmic Trading

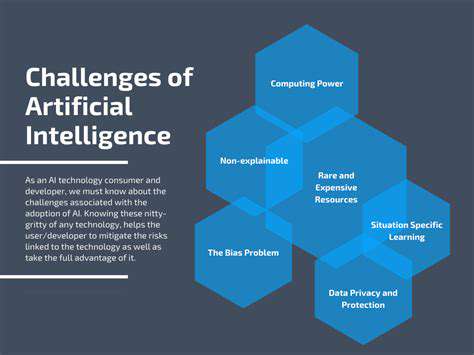

The growing dependence on artificial intelligence within investment circles presents several moral dilemmas. Algorithmic trading platforms, powered by intricate mathematical models, might unintentionally widen current market disparities. For example, should a system prioritize specific asset classes based on historical patterns that mirror pre-existing prejudices, it could further sideline less represented investors and their approaches. This scenario brings to light issues surrounding justice and equal access to financial opportunities. Additionally, the black box nature of certain AI implementations complicates efforts to comprehend how investment selections are formulated, possibly obstructing responsibility and openness in finance.

Clarity in how AI-driven investment tools reach conclusions is absolutely essential. Those investing their money have a right to grasp the logic guiding significant financial commitments, particularly when large sums are involved. Absent this understanding, confidence in AI-based investment methodologies will deteriorate, potentially destabilizing broader financial markets.

Bias in AI Models and Data

Since artificial intelligence systems learn from existing information, they inherently adopt and sometimes magnify any prejudices present in their training data. Consider this: if past market information overwhelmingly favored particular demographic groups or investment tactics, the AI will likely continue favoring those same approaches, potentially overlooking other lucrative possibilities. Identifying and addressing these embedded prejudices is fundamental to creating just and balanced investment results.

The subtle prejudices within AI training datasets can produce far-reaching effects, resulting in inequitable investment behaviors. Meticulous examination of potential data biases, combined with active efforts to diversify datasets and implement corrective measures, becomes indispensable.

The Role of Regulation and Oversight

With artificial intelligence assuming greater responsibility in portfolio management, comprehensive regulatory structures and monitoring systems become imperative. Well-defined protocols must be established to promote ethical AI deployment while managing risks like algorithmic prejudice and potential market distortions. Such frameworks should carefully weigh technological advancement against the need to preserve market fairness and investor safeguards.

Creating unambiguous standards governing AI applications in finance proves vital. These guidelines will help guarantee that intelligent systems are designed and implemented following moral guidelines while supporting economic stability. Moreover, continuous evaluation and refinement of these regulations will be necessary to match the swift progress of AI technologies.

The Impact on Human Expertise and Jobs

The accelerating automation of investment processes via artificial intelligence sparks worries about the continuing relevance of human specialists. While AI excels at handling repetitive functions, human supervision and nuanced judgment remain irreplaceable for sophisticated investment approaches and unexpected market developments. This shift demands extensive retraining programs to prepare financial experts for productive collaboration with intelligent systems.

Potential job losses among investment professionals present serious challenges. Academic institutions and industry groups must consequently revise their educational programs to ready future finance experts for cooperative engagements with AI. This preparation should encompass thorough comprehension of artificial intelligence capabilities, its constraints, and optimal methods for integrating it with human analysis.

Data Security and Privacy in AI Systems

Investment AI platforms depend extensively on massive datasets, raising important questions about information protection and confidentiality. Safeguarding sensitive financial records from cyber threats and unauthorized exposure becomes absolutely critical. Implementing strong protective measures and advanced encryption standards proves essential for defending investor assets. Strict adherence to applicable data privacy laws also remains non-negotiable.

The susceptibility of AI platforms to digital intrusions warrants serious attention. Shielding the enormous volumes of financial information processed by investment AI demands comprehensive security strategies. These must incorporate powerful digital barriers, sophisticated threat detection systems, and periodic vulnerability assessments to pinpoint and rectify potential security gaps.

The Need for Transparency and Explainability

The opaque decision-making processes characteristic of certain AI algorithms create substantial obstacles to comprehending investment rationale. Enhanced clarity and interpretability in AI operations are vital for establishing credibility and responsibility. Creating techniques to elucidate and justify AI-generated investment selections will prove crucial for gaining the trust of both investors and regulatory bodies.

When AI investment models lack clear explanatory mechanisms, both regulators and investors face difficulties evaluating the equity, precision, and ethical dimensions of automated decisions. Developing methodologies to interpret and clarify AI-driven investment approaches serves dual purposes: building confidence while simultaneously uncovering and neutralizing potential prejudices and hazards.