Optimizing Investment Strategies with AI-Powered Insights

Investment Diversification Strategies

Diversifying your investment portfolio is crucial for mitigating risk and maximizing potential returns. By spreading your investments across various asset classes, you can lessen the impact of any single investment's poor performance on your overall portfolio. This strategy involves allocating capital to different stocks, bonds, real estate, or even alternative investments like commodities. Diversification helps to smooth out the volatility of the market, allowing your investments to weather economic downturns and capitalize on growth opportunities in different sectors.

Understanding the correlation between different asset classes is key to successful diversification. Investments with low correlations tend to perform independently of each other, reducing overall portfolio risk. For example, stocks and bonds often exhibit an inverse correlation, meaning that when one performs poorly, the other might perform relatively well. This creates a natural hedge against market fluctuations, protecting your portfolio's value.

Risk Tolerance Assessment and Management

A thorough understanding of your risk tolerance is paramount when creating an investment strategy. This involves honestly evaluating your comfort level with potential losses and your ability to withstand market fluctuations. A risk tolerance assessment considers your financial situation, time horizon, and personal goals, leading to the development of an investment portfolio that aligns with your individual circumstances and risk preferences.

Effective risk management involves setting realistic expectations and establishing stop-loss orders or other protective measures. This proactive approach helps to limit potential losses during market downturns and safeguard your hard-earned capital. It's essential to regularly monitor your portfolio and adjust your strategies as needed to maintain your risk tolerance and ensure you stay on track with your financial goals.

Long-Term Financial Goals and Planning

Establishing clear long-term financial goals, such as retirement savings or funding children's education, is fundamental to crafting an effective investment strategy. Defining these goals provides a roadmap for your investment decisions, ensuring that your investments are aligned with your aspirations and time horizons. This crucial step helps you make informed choices that maximize the potential for achieving your objectives.

Regular review and adjustments to your investment strategy are essential. Your financial situation and goals may change over time, requiring modifications to your investment plan. Staying informed about market trends and economic conditions is important to maintaining a well-balanced portfolio that continues to support your long-term financial objectives. Planning for these changes and adjusting accordingly is essential for long-term success.

The Future of AI in Financial Predictive Analytics

AI-Powered Forecasting Models

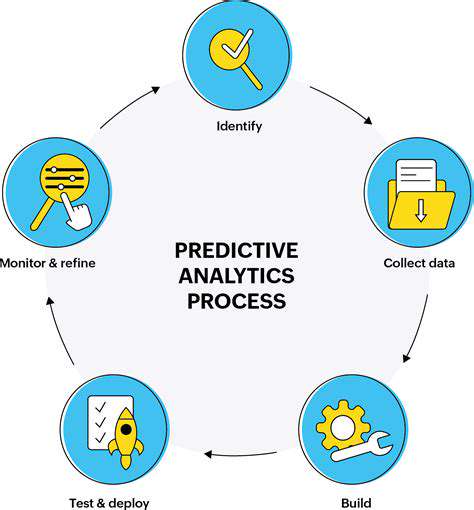

Artificial intelligence (AI) is rapidly transforming financial predictive analytics, enabling more accurate and timely forecasts. Sophisticated AI algorithms, like machine learning and deep learning models, can analyze vast datasets of financial information, including market trends, economic indicators, and historical financial performance, to identify patterns and predict future outcomes with greater precision than traditional methods. This allows financial institutions to make more informed decisions regarding investment strategies, risk management, and portfolio optimization, ultimately leading to improved profitability and reduced risk exposure. The ability to process and interpret complex data sets quickly and efficiently is a key advantage of AI-driven forecasting models.

These models can be trained on historical data to identify patterns and relationships that might be missed by human analysts. By learning from past performance, AI can adapt to changing market conditions and refine its predictions over time. This adaptive learning capability is crucial for staying ahead of evolving market dynamics and ensuring the accuracy of financial forecasts in the face of uncertainty.

Enhanced Risk Management

AI significantly enhances risk management capabilities in the financial sector. By analyzing vast datasets of financial transactions, market data, and customer behavior, AI algorithms can identify potential risks and vulnerabilities more effectively than traditional methods. This allows for proactive risk mitigation strategies, such as early detection of fraudulent activities, identification of emerging market risks, and effective credit scoring models.

AI-powered risk management systems can process and analyze data in real-time, enabling instantaneous responses to emerging threats. This real-time analysis is crucial for maintaining financial stability and minimizing potential losses. The ability to anticipate and mitigate risks, rather than simply reacting to them, is a major advantage of AI in finance.

Improved Portfolio Optimization

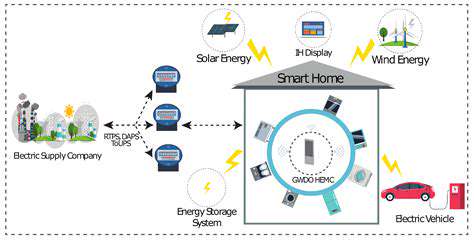

AI algorithms can optimize investment portfolios by considering a wider range of factors and market conditions. Traditional portfolio optimization methods often rely on static assumptions and limited data sets. AI-powered solutions can analyze real-time market data, economic indicators, and individual investor preferences to dynamically adjust portfolio allocations for optimal returns and risk mitigation. This dynamic adaptation to market changes is key to maximizing returns and minimizing risk in a constantly evolving financial landscape.

By incorporating factors such as individual investor risk tolerance and financial goals, AI can create customized portfolio strategies that align with specific investor needs. This personalized approach to portfolio optimization leads to more tailored and effective investment strategies for individual investors and institutional clients alike.

Personalized Financial Advice

AI is revolutionizing financial advice by providing personalized recommendations and support to individuals and businesses. AI-powered chatbots and virtual assistants can answer financial questions, provide personalized investment advice, and offer ongoing support to clients. This accessibility and personalized touch enhance the overall client experience and foster stronger client relationships.

Moreover, AI can analyze individual financial situations to provide tailored recommendations for budgeting, saving, investing, and debt management. This personalized approach enables financial institutions to provide more effective and relevant financial guidance, leading to better financial outcomes for clients.

The Role of Big Data and Data Science

The effectiveness of AI in financial predictive analytics hinges on the availability and quality of big data. A robust data infrastructure is essential to provide the volume, velocity, and variety of data required to train and refine AI models. Data scientists play a crucial role in collecting, cleaning, and preparing this data for AI algorithms, ensuring that the models are accurate and reliable. The integration of data science principles is critical to the success of AI in financial predictive analytics, ensuring that models are built on a solid foundation of data quality and analysis.

The growing importance of data governance and security is also critical. Protecting sensitive financial data from breaches and ensuring compliance with regulations is paramount in the deployment of AI in financial applications. Robust security measures are vital to maintain consumer trust and prevent significant financial harm.