Quantum Machine Learning for Fraud Detection and Risk Assessment

Quantum Computing's Potential in Fraud Detection

Quantum computing, with its ability to manipulate qubits and leverage quantum phenomena like superposition and entanglement, holds immense promise for revolutionizing fraud detection. This groundbreaking technology promises to tackle complex problems that are intractable for classical computers. The potential to analyze vast datasets and identify intricate patterns indicative of fraudulent activities is a significant advancement in the field. This approach can potentially uncover subtle anomalies and correlations that might be missed by traditional methods.

Current fraud detection systems often rely on algorithms that struggle with the sheer volume and complexity of modern financial transactions. Quantum algorithms, on the other hand, could process this data much faster and more efficiently, leading to significant improvements in detection rates. This enhanced computational power could be particularly valuable in identifying sophisticated and evolving fraud schemes that are difficult to anticipate using conventional techniques.

Quantum Machine Learning Algorithms for Fraud Analysis

Quantum machine learning algorithms, specifically designed to utilize the unique capabilities of quantum computers, are likely to be crucial in this new approach to fraud detection. These algorithms can potentially identify intricate patterns and anomalies in large datasets of financial transactions, going beyond the limitations of traditional machine learning models.

Different quantum machine learning algorithms, such as quantum support vector machines and quantum neural networks, could be tailored to specific types of fraud, such as credit card fraud, insurance fraud, and money laundering. This tailored approach could significantly improve the accuracy and efficiency of fraud detection in various financial sectors.

Data Preparation and Feature Engineering in Quantum Fraud Detection

Preparing data for quantum algorithms requires a specific approach. Traditional data preprocessing steps, like feature scaling, data cleaning, and dimensionality reduction, will still play a crucial role. However, the nature of quantum algorithms necessitates a unique consideration for data representation and feature engineering.

Challenges and Limitations of Quantum Fraud Detection

While the potential of quantum machine learning for fraud detection is significant, several challenges and limitations must be addressed. One major hurdle is the limited availability and accessibility of quantum computers with sufficient processing power to handle real-world financial datasets. The cost and complexity associated with building and maintaining such systems pose significant barriers to widespread adoption.

Furthermore, the development of robust and reliable quantum algorithms for fraud detection is still an ongoing process. Ensuring the accuracy and reliability of these algorithms is crucial for their practical application in the financial industry. The need for rigorous testing and validation is paramount before implementation.

Future Directions and Applications

Future research in this field will likely focus on developing more efficient quantum algorithms and hardware platforms. The integration of quantum machine learning with existing fraud detection systems promises to create a more comprehensive and robust approach. This integration could lead to the development of hybrid systems combining the strengths of both classical and quantum techniques. Further, the development of quantum-enhanced fraud detection tools could pave the way for more proactive and preventative measures in the financial sector.

The long-term impact of quantum machine learning on fraud detection could be transformative, leading to a more secure and efficient financial ecosystem.

Quantum Simulation for Market Simulation and Forecasting

Quantum Simulation for Enhanced Market Understanding

Quantum simulation offers a potentially revolutionary approach to understanding and predicting market behavior. By simulating complex interactions within financial markets, quantum algorithms can identify patterns and relationships that are currently hidden within the vast datasets used for traditional market analysis. This capability extends beyond traditional statistical methods, providing deeper insights into the intricate interplay of market forces, investor sentiment, and economic factors. The potential for identifying subtle, previously overlooked trends could lead to more accurate forecasting and improved portfolio optimization strategies.

Traditional methods often struggle with the inherent complexity and non-linearity of financial markets. Quantum simulation, however, can model these dynamic systems with unprecedented precision, potentially uncovering hidden correlations and causal links. This ability to capture the nuances of market behavior could lead to a significant advancement in our understanding of how markets operate, offering opportunities for more robust and reliable predictions.

Developing Quantum Algorithms for Financial Forecasting

The development of specialized quantum algorithms tailored for financial forecasting is a crucial step in leveraging the potential of quantum computing in this field. These algorithms would need to efficiently process vast amounts of financial data, identifying patterns and correlations that are difficult or impossible to detect using classical methods. This process could involve simulating complex interactions between various market participants, such as investors, traders, and institutions, to understand how their actions collectively influence market trends.

The design of these algorithms will be a significant undertaking, requiring expertise in both quantum computing and financial modeling. It will be essential to ensure that the algorithms are not only computationally efficient but also produce reliable and meaningful results that can be used for practical forecasting purposes. Furthermore, the algorithms will need to be robust enough to handle the inherent noise and uncertainty present in real-world financial data.

Quantum Simulation for Risk Assessment and Portfolio Optimization

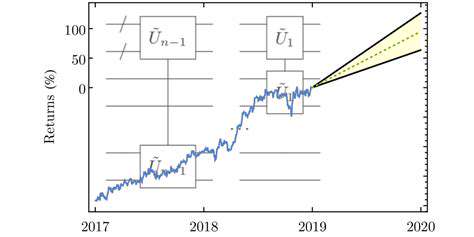

One of the most compelling applications of quantum simulation in finance is its potential for enhancing risk assessment and portfolio optimization. By simulating various market scenarios and their potential outcomes, quantum algorithms could provide a more comprehensive understanding of the risks associated with different investment strategies. This capability allows for the evaluation of a broader range of potential outcomes, going beyond the limitations of traditional risk models.

Furthermore, quantum simulation can facilitate the optimization of investment portfolios. By considering a wider range of factors and interactions, quantum algorithms could identify optimal portfolio allocations that are more resilient to market fluctuations and yield higher returns. This represents a significant advancement over existing portfolio optimization techniques, potentially leading to more sophisticated and effective investment strategies.

Quantum simulation also has the potential to reveal hidden dependencies and correlations within financial instruments and markets. This could lead to a more nuanced understanding of risk and opportunity, ultimately benefitting investors and financial institutions.

Quantum simulation could also identify previously unseen patterns in market fluctuations that could help predict and mitigate risks.

By incorporating quantum simulation into risk assessment models, financial institutions could potentially reduce their exposure to unforeseen market events and develop more resilient investment strategies.