Exploring Multiple Futures with AI

Modern artificial intelligence systems possess an unparalleled ability to generate diverse potential scenarios, far surpassing human cognitive limitations. Rather than simply forecasting market trends, these systems explore countless hypothetical situations—factoring in geopolitical developments, technological disruptions, and economic fluctuations. By synthesizing historical patterns, current market data, and expert analyses, AI creates detailed scenario frameworks that illuminate various possible futures.

This multifaceted scenario generation proves invaluable for proactive risk management. Organizations can evaluate potential impacts across multiple eventualities rather than relying on single-point predictions. Such comprehensive analysis enables more resilient strategic planning, particularly in finance where unexpected events carry significant consequences.

Connecting Disparate Data Streams

AI's true strength lies in its capacity to synthesize information from varied sources—financial records, news reports, social media, research findings, and even meteorological data. By detecting correlations across these traditionally siloed datasets, AI identifies emerging patterns that human analysts might overlook. This comprehensive approach yields a more complete understanding of market dynamics and potential risks.

The integration of structured quantitative data with qualitative, unstructured information allows for richer scenario development. This convergence creates a nuanced perspective on the complex factors influencing financial markets and organizational risk profiles.

Evolving Scenario Analysis

AI-powered scenario planning represents a dynamic, ongoing process rather than a static exercise. Models continuously refine their outputs as new data emerges and market conditions shift. This adaptive capability proves essential for identifying developing risks and adjusting strategies in response to changing circumstances.

The real-time responsiveness of AI systems provides a critical advantage in risk management. Financial institutions can modify their approaches based on unfolding events, maintaining agility in volatile markets.

Advanced Risk Evaluation

Artificial intelligence dramatically improves both the precision and speed of risk assessment. By detecting historical patterns, these systems can pinpoint vulnerabilities and calculate risk probabilities with remarkable accuracy. This predictive capacity enables financial organizations to implement preventative measures and adjust strategies based on AI-identified risks.

Such proactive risk management better prepares institutions for diverse market conditions, reducing potential losses and optimizing performance across various economic scenarios.

Informed Strategic Decisions

AI-generated scenario analyses significantly enhance organizational decision-making. By presenting multiple potential outcomes with associated probabilities, these systems provide a robust foundation for strategic choices. Financial leaders can leverage these insights when making investment decisions, developing risk policies, and constructing portfolios.

This data-driven approach proves particularly valuable in navigating today's complex, uncertain financial landscapes where traditional forecasting methods often fall short.

Customized Scenario Responses

AI facilitates the development of tailored strategies for specific scenarios. Recognizing that different situations demand distinct responses, these systems evaluate each scenario's potential business impact to recommend optimal mitigation approaches. This precision targeting ensures efficient resource allocation and strengthens institutional resilience.

By adapting strategies to address the unique challenges of each potential future, organizations can develop more effective risk management frameworks capable of responding to diverse market conditions.

When measuring dry ingredients like flour, sugar, and cocoa powder, using a properly calibrated kitchen scale is often the most accurate method. Simply scooping ingredients directly from the bag or container into measuring cups can lead to significant inaccuracies due to packing density. A scale ensures every gram is accounted for, guaranteeing consistent outcomes.

Streamlining Financial Forecasting with Advanced Technology

Precision Through AI Modeling

Modern AI systems excel at uncovering complex relationships within extensive datasets, offering substantial improvements over conventional forecasting approaches. Machine learning algorithms analyze historical financial data, market movements, and economic indicators to produce more reliable projections. This enhanced accuracy supports better resource allocation and investment strategy optimization.

Deep learning architectures further refine predictions by modeling intricate factor interactions. This sophisticated analysis reduces uncertainty and improves forecast reliability, enabling proactive responses to emerging market trends.

Automated Forecasting Systems

Traditional financial forecasting often consumes considerable time and remains susceptible to human error. AI-driven automation streamlines this process, dramatically reducing manual effort. These systems aggregate and analyze data from multiple sources, allowing analysts to focus on higher-value strategic work.

Automated data processing minimizes the errors inherent in manual methods, while simultaneously accelerating the entire forecasting cycle. This efficiency gain enables faster responses to evolving market conditions.

Dynamic Data Integration

AI systems uniquely process real-time information streams, creating responsive forecasting capabilities. Incorporating market news, economic updates, and social sentiment enables more agile strategic adjustments. This real-time awareness helps businesses mitigate risks and capitalize on emerging opportunities.

The continuous integration of current data allows AI models to adapt more effectively than traditional methods. In today's volatile financial environment, this responsiveness proves invaluable for maintaining competitive advantage.

Transparent Analytical Processes

While AI models can be complex, advancements in explainable AI are improving prediction transparency. Clearer understanding of the reasoning behind forecasts builds organizational trust in AI-driven insights. This explanatory capability facilitates better internal communication and more informed decision-making processes.

By elucidating the factors influencing predictions, businesses gain deeper insight into market dynamics, strengthening the overall forecasting framework.

The Evolving Landscape of Financial Forecasting

AI's Transformational Impact

Artificial intelligence is revolutionizing financial forecasting through unprecedented analytical capabilities. Advanced algorithms process vast datasets, detecting patterns beyond human perception. This results in more accurate predictions that enhance both resource allocation and risk mitigation. AI's real-time adaptability represents another significant advantage in dynamic markets.

Machine learning models demonstrate particular strength in financial applications, continuously improving their predictions as new data becomes available. The automation potential allows human analysts to concentrate on strategic interpretation rather than data processing.

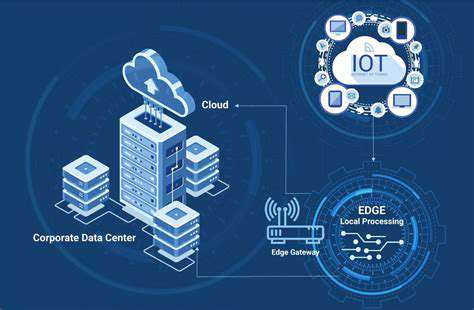

Comprehensive Data Utilization

The exponential growth of financial data necessitates sophisticated processing techniques. Modern forecasting integrates diverse information streams—including social sentiment, economic indicators, and market news—to create more complete financial pictures.

Cloud-based analytics platforms enable real-time data processing, supporting quicker, more informed business decisions. This capability proves essential for responding effectively to market fluctuations.

Enhanced Predictive Accuracy

AI-driven models consistently outperform traditional forecasting methods in prediction accuracy. This precision improvement directly benefits investment strategies, risk assessment, and financial planning. By reducing uncertainty, these models support more confident decision-making.

The statistical sophistication and machine learning capabilities underlying these systems account for their superior performance, moving financial forecasting beyond reliance on intuition or estimation.

Adaptive Forecasting Models

Financial markets' constant evolution demands forecasting tools that can adjust in real time. AI systems excel at incorporating new information to refine their projections, creating more responsive forecasting processes.

This adaptability proves particularly valuable during market volatility, helping mitigate the impact of unexpected developments through timely adjustments.

Incorporating Unconventional Data

AI models extend beyond traditional financial metrics to include alternative data like social media trends, news analysis, and environmental factors. This broader perspective identifies subtle patterns often missed by conventional methods, resulting in more nuanced predictions.

The inclusion of diverse data sources enhances risk identification and opportunity recognition, significantly improving forecast quality.

Blockchain's Emerging Role

Blockchain technology is becoming increasingly important for financial forecasting. Its decentralized, secure architecture enables transparent data exchange, improving forecast reliability. The immutable nature of blockchain records ensures data integrity, fostering trust in predictive outputs.

This technological combination creates more robust forecasting systems essential for sound financial decision-making.

Ethical Implementation Considerations

While AI offers tremendous forecasting potential, ethical implementation remains crucial. Issues including algorithmic bias, transparency, and workforce impacts require careful attention. Developing appropriate governance frameworks will ensure responsible AI adoption in financial applications.

Maintaining data security and system integrity also represents an ongoing challenge that must be addressed as these technologies evolve.