AI-Powered Budgeting: A Personalized Approach

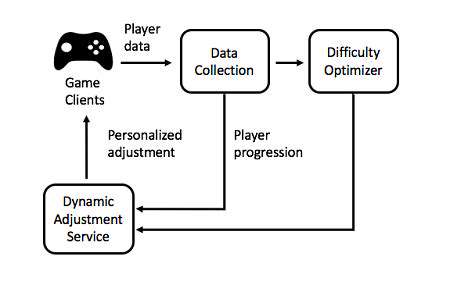

Modern financial tools are transforming personal finance management, evolving beyond basic investment platforms to deliver customized budgeting solutions. These applications examine spending behaviors, highlight potential savings opportunities, and forecast upcoming financial requirements. This adaptive method utilizes extensive datasets to provide recommendations suited to each user's unique situation, proving significantly more effective than standardized budgeting frameworks. For instance, advanced algorithms can detect regular payments, suggest unnecessary subscriptions to cancel, and recommend automated savings transfers.

Contemporary financial tools do more than monitor expenditures; they decode financial psychology. By evaluating transaction histories, these systems can pinpoint spending catalysts and offer customized approaches for controlling spontaneous purchases or excessive spending in particular areas. This profound insight into monetary habits enables users to develop more durable and practical financial strategies, transitioning from passive record-keeping to active financial stewardship.

Boosting Financial Understanding Through Technology

Digital solutions are demonstrating remarkable value in improving financial knowledge. Interactive learning environments utilize adaptive technologies to create personalized educational journeys, adjusting to individual learning preferences and knowledge deficiencies. This flexible methodology enhances the effectiveness of financial education, helping people grasp intricate monetary principles through simplified explanations. From the power of compound growth to investment tactic navigation, these platforms deliver straightforward, digestible information that promotes better financial comprehension.

Moreover, intelligent systems can generate customized financial recommendations based on personal situations and objectives. This individualized method allows users to obtain tailored advice regarding debt handling, retirement preparation, or even financially significant career choices. Such personalized support proves particularly valuable for those without access to conventional financial consultants or who find personal finance overwhelming.

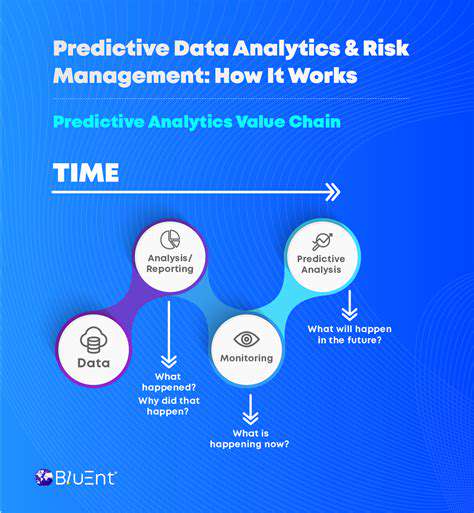

Forecasting Tools for Advanced Financial Strategy

The influence of modern technology reaches further than immediate budgeting by enabling sophisticated forecasting models. Advanced algorithms can evaluate economic patterns, market variations, and personal spending behaviors to predict potential future financial situations. This predictive capacity helps users prepare for possible difficulties, such as employment changes or significant life transitions, allowing them to proactively modify their financial approaches. Such forward-looking insight enables more educated choices regarding savings, investments, and debt control in preparation for future requirements.

By anticipating possible future developments, individuals can establish backup plans and adjust their financial targets to enhance monetary security. This proactive strategy, powered by technology's ability to process enormous datasets, transforms financial planning from reactive adjustments to deliberate, future-oriented planning, ultimately improving overall financial health.

The Evolution of Asset Management Through Technology: Improved Availability and Effectiveness

The Emergence of Automated Investment Platforms

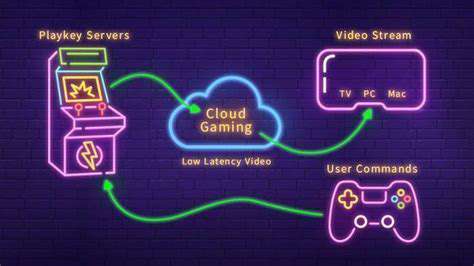

Automated investment platforms are dramatically altering the asset management industry, providing algorithm-driven investment approaches with reduced costs compared to conventional financial consultants. These systems employ complex calculations and data interpretation to construct customized investment plans aligned with personal objectives and risk preferences. This movement toward automation is democratizing asset management, particularly for younger investors. However, this accessibility also raises questions about the potential limitations in personalized financial guidance.

The underlying technology continues to advance, integrating more refined algorithms and improved data analysis methods. This enables platforms to respond to market fluctuations and deliver more responsive investment tactics. While they may not offer the human touch of traditional advisors, they provide substantial benefits regarding affordability and ease of use.

Customized Financial Roadmapping

Future asset management approaches will place greater emphasis on individualized financial roadmapping, progressing beyond standardized investment mixes to address each client's distinctive requirements and aspirations. This demands a thorough comprehension of personal situations, including career paths, family dynamics, and lifetime ambitions.

Customized financial roadmapping extends far beyond investment supervision; it involves complete strategies for realizing specific life milestones, whether purchasing property, financing education, or preparing for retirement. This methodology focuses on preventive measures, ensuring clients maintain progress toward their financial targets.

Comprehensive Wellness Integration

Asset management is expanding its scope to incorporate a wider viewpoint, recognizing the interdependence between financial stability and general well-being. This all-encompassing approach accepts that monetary health is fundamentally connected to psychological and physical health, promoting a more harmonious and sustainable method for wealth accumulation and management.

Technological Advancements in Finance

Technological innovation will remain crucial in molding asset management's future, introducing improvements in areas like investment portfolio oversight, risk evaluation, and personalized financial consultation. These technological developments will simplify procedures, increase productivity, and ultimately make professional financial guidance more obtainable and cost-efficient for everyone.

The application of sophisticated data analysis and predictive modeling will be essential for processing enormous datasets to spot investment possibilities and evaluate risk elements more efficiently. This progression will result in more accurate and responsive investment methodologies.

Responsible and Value-Aligned Investing

A growing number of investors are pursuing investment approaches that reflect their principles and support sustainable development. Responsible investing is gaining popularity as market participants emphasize organizations showing social accountability and environmental awareness.

This movement demonstrates increasing recognition of environmental, social, and governance considerations in investment selections. Financial consultants are responding by including sustainable investment approaches in their offerings, constructing portfolios that balance profitability with social responsibility.

The Changing Role of Financial Consultants

While automated platforms are becoming more prevalent, human financial consultants will likely transform rather than vanish. Professionals will concentrate more on delivering customized advice, cultivating lasting client relationships, and assisting with navigating complicated financial circumstances.

Affluent individuals and families will probably continue depending on human expertise for sophisticated financial planning, estate arrangement, and wealth transition strategies. These professionals will serve as reliable allies, offering specialized guidance for complex financial decisions.

International Asset Management Considerations

The growing integration of global markets is creating demand for asset management approaches that cross national boundaries. Managing resources in multiple countries and currencies requires specialized understanding and skills. This complexity will only intensify as international investments become more prevalent.

Global interconnectedness also introduces distinct challenges, including variations in regulatory systems and taxation policies. Financial professionals must adjust to these obstacles and develop advanced solutions for handling the intricacies of cross-border asset management.