Beyond the Hype: Understanding the Market

Digital art has witnessed explosive growth since artists like Beeple achieved mainstream recognition. Yet the sensational headlines about multi-million dollar sales frequently distract from the deeper market forces at play. To properly assess this rapidly changing landscape, we must look past the initial excitement.

The involvement of traditional galleries and auction houses in digital spaces, alongside the emergence of new platforms and participants, requires careful examination. Additionally, we should consider how investor psychology, evolving digital copyright laws, and the sector's financial stability all influence market behavior.

Decentralized Autonomous Organizations (DAOs): A New Force

DAOs are transforming digital art through innovative approaches to ownership and governance. These decentralized entities enable direct connections between creators and collectors, often eliminating middlemen. This model offers artists unprecedented control over their work's distribution and future.

The Role of Technology in Shaping the Market

Blockchain, NFTs, and digital creation tools are fundamentally changing artistic production and exchange. These technologies serve as both enablers and mediums for new forms of creative expression. Traditional art institutions must now contend with these disruptive innovations that offer fresh opportunities for artists and buyers.

The Impact on Traditional Art Galleries and Auction Houses

Established art institutions face significant challenges from digital markets. Many are responding by incorporating digital works into their catalogs, acknowledging this emerging segment's potential. Successful adaptation demands balancing conventional standards with digital innovation. Traditional players must develop thoughtful strategies to remain relevant in this transformed environment.

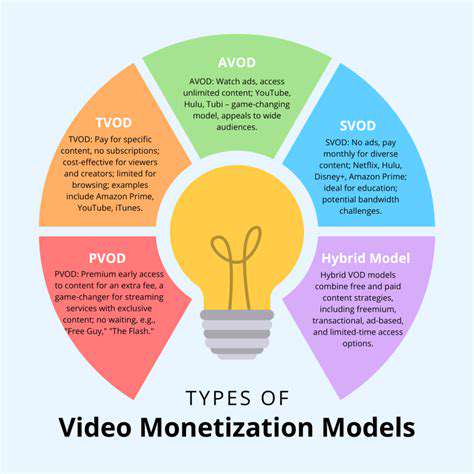

The Future of Valuation and Pricing

Digital art valuation presents unique complexities. Unlike physical artworks, digital pieces derive worth from factors like rarity, creator reputation, community involvement, and market momentum. The unpredictable nature of online trends creates both risks and opportunities for participants in this space.

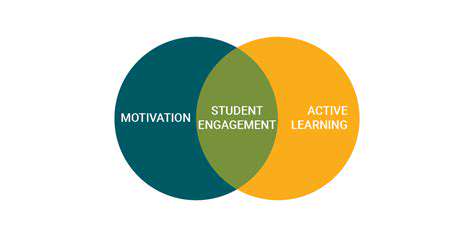

The Importance of Community and Engagement

Beyond technical specifications, digital art's value stems from its community. Active participation and strong online connections help artists develop meaningful relationships with collectors. Vibrant communities enhance artworks' perceived worth while improving experiences for all involved.

Ethical Considerations and the Future of Ownership

Digital art raises important questions about copyright, authenticity, and preservation. Issues like potential manipulation, forgery, and long-term accessibility require careful attention as the market continues to mature.

Decentralized Ownership and the Role of Blockchain

Decentralized Ownership: Redefining Asset Ownership

Blockchain-based decentralized ownership fundamentally changes asset management. This technology eliminates dependence on central authorities, giving individuals direct control through cryptographic methods. The implications extend beyond simple possession to include autonomous management of rights and transfers.

Blockchain's Role in Secure Transactions

Blockchain provides the infrastructure for decentralized ownership through its distributed ledger system. Replicated across multiple points, this network creates tamper-proof records essential for verifying ownership histories. Cryptographic signatures add another layer of security surpassing traditional centralized systems.

NFTs: The Genesis of Decentralized Digital Ownership

NFTs exemplify decentralized ownership for digital assets. These unique tokens authenticate ownership of digital creations while enabling trading on decentralized platforms. This system empowers creators and collectors alike within a more transparent ecosystem.

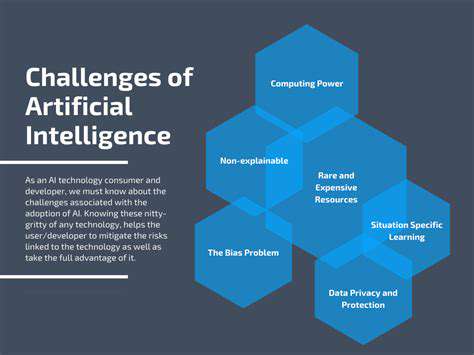

Challenges and Considerations in Decentralized Ownership

Despite advantages, decentralized systems face hurdles including potential security issues and accessibility barriers. Simplifying complex technical aspects remains crucial for broader adoption and realizing the technology's full potential.

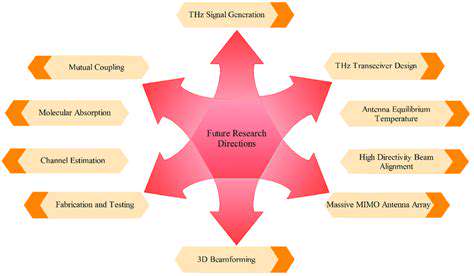

The Future of Decentralized Ownership in the Digital Economy

Decentralized ownership promises to transform numerous industries beyond digital assets. As blockchain applications expand, we'll likely see innovations in supply chain tracking, intellectual property management, and other sectors requiring verifiable ownership records.

Beyond Digital Assets: Expanding the Scope of Decentralized Ownership

The principles of decentralized ownership could eventually apply to physical assets like real estate or vehicles. Blockchain-based tracking systems may revolutionize how we manage and transfer ownership across multiple industries.

The Technical Nuts and Bolts: Understanding the Mechanics

Blockchain Technology: The Foundation

NFTs rely on blockchain's decentralized ledger system, which creates permanent, verifiable transaction records. This technology groups transactions into chronologically-linked blocks secured by cryptographic hashing, forming an immutable foundation for digital ownership.

Smart Contracts: Automating Transactions

Smart contracts encode agreement terms directly into executable code stored on blockchains. These self-executing contracts automate processes like ownership transfers and royalty payments while reducing reliance on intermediaries.

Metadata: Describing the Asset

NFT metadata provides essential details about digital assets including creator information, descriptions, and provenance. This accompanying data facilitates discovery, verification, and integration with other platforms while enhancing market transparency.