The Impact of AI on Market Efficiency and Volatility

AI-Powered Algorithmic Trading Strategies

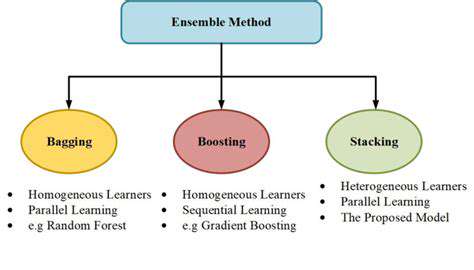

AI is transforming algorithmic trading strategies through advanced pattern recognition and predictive modeling. By analyzing extensive datasets—including historical prices, trading volume, and order book data—AI algorithms can spot subtle market trends and anomalies invisible to human traders. This fosters more sophisticated and dynamic strategies, potentially accelerating market responses to new information.

These strategies often employ machine learning, enabling algorithms to adapt and enhance their performance over time. This adaptive capability can unlock more profitable opportunities and improve capital allocation efficiency.

Enhanced Market Transparency and Information Processing

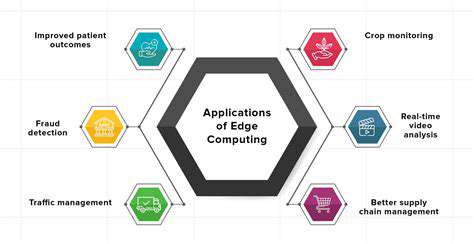

AI’s real-time data processing significantly boosts market transparency. Algorithms can analyze diverse sources—news, social media sentiment, economic indicators, and regulatory updates—providing traders with a comprehensive view of market conditions. This enables more informed decisions grounded in a broader information spectrum.

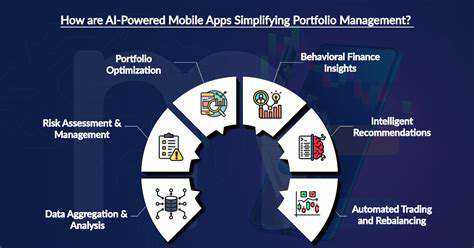

Improved Risk Management and Portfolio Optimization

AI-driven tools elevate risk management by identifying portfolio vulnerabilities, allowing proactive adjustments to mitigate losses. Advanced algorithms can also optimize portfolios dynamically, aligning asset allocation with real-time market conditions and individual risk profiles, potentially enhancing investor returns.

Potential for Increased Market Volatility

While AI enhances market efficiency, it may also amplify volatility. Widespread adoption of AI-driven algorithms could lead to synchronized trading actions and rapid high-frequency executions. The interconnectedness of these algorithms might trigger cascading effects, where one algorithm’s reaction is amplified by others.

Limited human oversight in some AI systems could exacerbate abrupt price swings, underscoring the need to manage these risks effectively.

The Impact on Human Traders

The rise of AI-driven trading is redefining human traders’ roles. While AI automates many tasks, humans will likely focus on strategic decisions, portfolio management, and risk assessment. This shift demands new skills in AI-driven analysis and regulatory compliance.

Ethical Considerations and Regulatory Challenges

AI in finance introduces ethical dilemmas, including data bias, market manipulation risks, and algorithmic opacity. As AI evolves, regulatory frameworks must adapt to address these challenges, ensuring data privacy, transparency, and safeguards against misuse.

The Future of AI in Algorithmic Trading

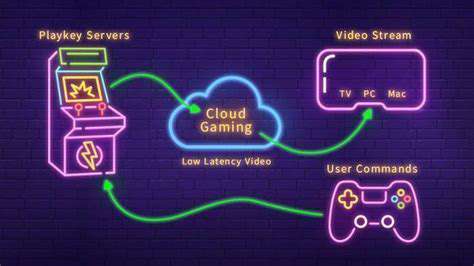

The future promises continued innovation, with more advanced algorithms integrating machine learning, blockchain, and quantum computing. Navigating this complexity requires collaboration among researchers, regulators, and market participants to ensure responsible AI deployment.

Ethical Considerations and Future Implications

Transparency and Accountability

Transparency in AI development is critical for building trust and mitigating harm. Disclosing algorithms, data sources, and potential biases enables stakeholders to understand AI operations and hold developers accountable. Transparency also fosters public engagement and informed decision-making.

Accountability mechanisms must address unintended consequences. Clear responsibilities for AI design, implementation, and monitoring are essential, including processes for redress. Independent oversight bodies can further ensure accountability by investigating and recommending improvements.

Bias and Fairness

AI systems trained on biased data may perpetuate discrimination in areas like lending or hiring. Mitigating bias requires diverse data collection, algorithmic design adjustments, and continuous monitoring. Fairness in AI demands a nuanced understanding of historical data contexts and their impacts on different groups.

Privacy and Data Security

AI’s reliance on personal data necessitates robust security measures, including encryption and access controls. Strong privacy regulations are vital to govern data collection, storage, and usage in AI applications.

Job Displacement and Economic Impact

AI-driven automation may displace jobs across sectors. Proactive measures like reskilling programs are essential, but a broader societal response is needed to address economic shifts and ensure a just transition for affected workers.

Societal Impact and Governance

AI’s societal implications span healthcare, education, and law enforcement. Responsible development requires ethical guidelines and public dialogue. Engaging diverse stakeholders ensures AI aligns with societal values and goals.