Decentralization's Impact on Trust

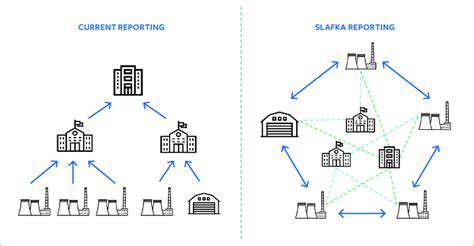

Decentralization reshapes how we establish and maintain trust. Rather than depending on centralized entities, it leverages a network of distributed participants. This approach creates a more resilient framework, as trust isn’t tied to a single vulnerable point.

Such a model proves invaluable where traditional authorities fall short in reliability or integrity. It cultivates a transparent and secure ecosystem, enabling seamless collaboration without concerns about undue influence or fraud.

The Role of Blockchain Technology

At the heart of decentralization lies blockchain technology. Its cryptographic safeguards and unchangeable records lay the groundwork for trustworthy transactions. Every participant in a blockchain network accesses identical data, promoting accountability and openness.

The permanence of blockchain entries is vital for sustaining confidence, as it bars unauthorized alterations. This reliability supports diverse uses, from monetary exchanges to tracking goods across supply chains.

Decentralization and Data Security

By scattering data across numerous nodes, decentralization bolsters security. Attackers face a daunting challenge, needing to breach multiple access points at once. This setup also ensures information remains available even if parts of the network fail.

Fragmented storage likewise enhances privacy. Sensitive details dispersed throughout a network thwart attempts at comprehensive data harvesting by any single party.

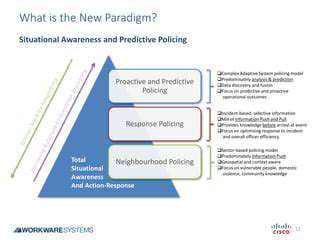

Decentralized Governance Models

These frameworks provide alternatives to top-down control structures. They enable broader participation in organizational decisions, often yielding more equitable and diverse results compared to conventional hierarchies.

Challenges of Decentralization

While promising, decentralization isn't without hurdles. Linking disparate systems can prove technically demanding. Some applications may also struggle with handling massive transaction volumes efficiently.

Safeguarding decentralized networks demands unwavering attention and multi-layered protective measures. Their very nature requires comprehensive security strategies to counter evolving threats.

The Future of Decentralization

Decentralization's potential spans numerous sectors, from monetary systems to healthcare platforms. Its transformative power continues to attract substantial resources and creative energy across industries.

Widespread adoption depends on solving current technical limitations. As solutions for scale and compatibility develop, we'll witness deeper integration into mainstream systems.

Decentralization and Trust in the Digital Age

Trust forms the bedrock of digital interactions. Decentralization presents a viable counter to centralized models, building confidence through transparency and shared oversight. This proves especially relevant in our rapidly changing online world.

Decentralized systems could forge more secure and open digital spaces. They may hold the solution for establishing reliable frameworks where entities can cooperate with assured confidence.

The Future of Finance: Embracing the Blockchain Revolution

The Rise of Fintech

Financial technology continues its rapid expansion, overhauling conventional banking services with inventive approaches. Fintech innovators are redefining payment systems, credit facilities, and investment platforms, utilizing technology to democratize financial access while improving cost-effectiveness and operational efficiency. Mobile advancements, data analysis breakthroughs, and cloud infrastructure propel this transformation, pressuring legacy institutions to evolve or face obsolescence.

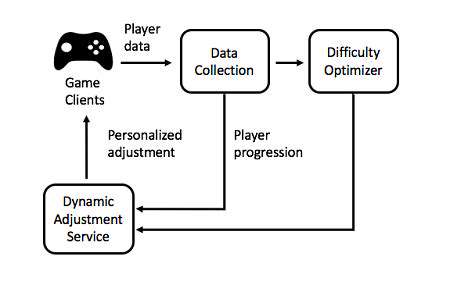

Personalized Financial Experiences

Finance is moving toward hyper-personalization. Institutions will harness customer data to craft bespoke financial products addressing individual circumstances. This customization will permeate investment guidance, credit offerings, and financial management tools.

Advanced planning instruments will likely emerge from this trend, empowering users to make smarter choices regarding wealth accumulation and fiscal objectives.

Increased Security Measures

With financial activities shifting online, protective measures grow increasingly critical. Future systems will prioritize cutting-edge security protocols to safeguard sensitive information against digital threats. Expect widespread adoption of enhanced encryption, layered authentication, and intelligent fraud monitoring. These safeguards will prove essential for maintaining user trust in digital financial services and preventing monetary losses.

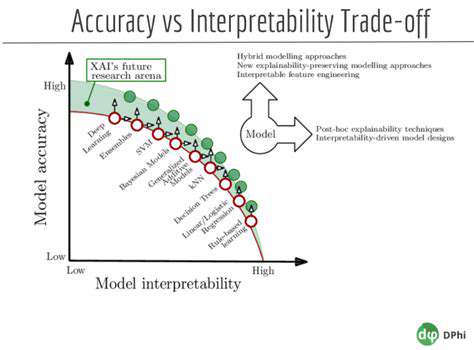

The Impact of Artificial Intelligence

AI is set to transform financial operations significantly. Machine learning systems can process enormous datasets to spot trends, forecast market movements, and automate processes like risk evaluation and fraud identification. This automation promises greater precision and operational efficiency.

Beyond streamlining operations, AI can deliver customized financial recommendations, helping individuals navigate complex monetary decisions with greater insight.

Blockchain Technology and Decentralization

Blockchain stands poised to disrupt conventional financial infrastructure, potentially overhauling transaction recording and verification processes. Its distributed architecture may enhance transparency while reducing intermediary dependencies, potentially creating leaner, more secure financial networks. International money transfers could become notably smoother and more accessible through this technology.

Blockchain's influence extends well beyond banking, touching sectors like logistics tracking and digital credentialing, underscoring its wide-ranging financial implications.