Enhancing Accuracy with Alternative Data

Conventional forecasting approaches typically depend on historical financial data and standard economic metrics. However, integrating non-traditional information sources can substantially improve forecast precision. Alternative data encompasses diverse inputs including digital sentiment indicators, media coverage, and geospatial information. Computational analysis of these sources reveals subtle market signals that conventional methods might miss. This methodology proves particularly effective for detecting emerging trends and potential market disturbances.

These supplementary data streams frequently offer insights into consumer patterns, market psychology, and logistical networks that traditional financial metrics don't capture. This detailed perspective enables more thorough understanding of economic conditions, resulting in more precise and adaptable forecasts.

Leveraging Social Media Sentiment Analysis

Digital platforms provide immediate access to collective opinions and market attitudes. By evaluating the quantity and nature of online discussions about specific businesses or economic developments, predictive models can detect market changes before they appear in conventional data. This early detection capability proves invaluable for making timely investment choices or modifying corporate strategies in response to shifting conditions. The immediacy and breadth of digital conversation data make it essential for current forecasting needs.

The Power of News Sentiment and Event Detection

Media reports and corporate announcements often contain crucial information about industry developments and regulatory modifications. Advanced algorithms process this content to identify significant themes, emotional tone, and noteworthy events that could influence market performance. This capability supports proactive identification of potential market movers and the creation of more resilient predictive models. Moreover, the rapid processing speed of these systems ensures timely response to breaking developments.

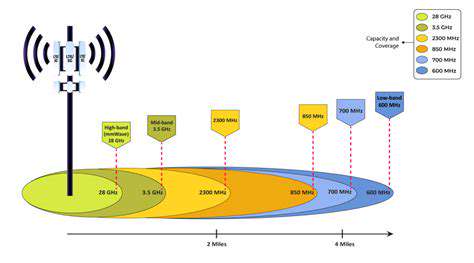

Improving Supply Chain Visibility through Satellite Imagery

Remote sensing technology offers unique insights into global logistics networks. By monitoring transportation flows and industrial activity, analytical systems can pinpoint potential supply chain issues or inefficiencies. This detailed supply chain intelligence enables more accurate production forecasting, delivery scheduling, and market supply predictions. These insights help businesses optimize operations and minimize disruption-related risks.

Predictive Modeling with Enhanced Granularity

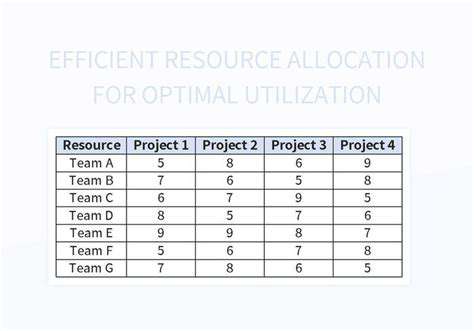

Integrating conventional financial metrics with alternative data enables construction of more detailed and comprehensive predictive models. These advanced models account for a wider array of market influences, yielding more accurate forecasts and deeper market understanding. The increased detail facilitates identification of subtle patterns and relationships that might otherwise remain undetected. The resulting models demonstrate greater responsiveness to real-time market fluctuations.

Real-Time Adjustments and Adaptive Forecasting

The inclusion of alternative data supports more flexible and dynamic forecasting methodologies. Predictive models can continuously incorporate new information, enabling immediate forecast revisions. This adaptability to changing market conditions proves essential for maintaining competitive advantage and making informed choices in volatile environments. This responsive approach is particularly valuable for effective risk management and return optimization in contemporary markets.

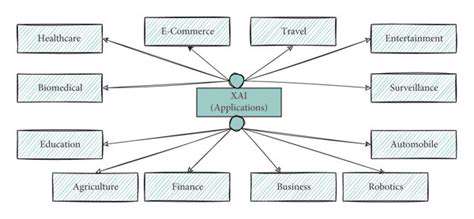

Beyond Financial Data: Exploring Non-Traditional Metrics

Modern forecasting extends well beyond standard financial indicators. By incorporating data from diverse sources including digital platforms, media analysis, and environmental factors, analytical systems develop more complete representations of market conditions. This comprehensive perspective enables more nuanced interpretation of economic trends and earlier identification of potential risks and opportunities. The expanded analytical scope supports development of more reliable predictive models.

While meatloaf is forgiving, several professional methods can elevate it from satisfactory to exceptional. Combining different meats - typically 80% beef with 20% pork - produces superior flavor and texture. Moistening breadcrumbs in milk rather than using them dry ensures a tender consistency. For ideal texture, mix ingredients only until just combined - excessive handling toughens the meat.