Predictive Modeling for Future Financial Needs

Understanding the Fundamentals of Predictive Modeling

Predictive modeling, a cornerstone of modern data science, involves using historical financial data and other relevant information to forecast future financial outcomes. This process leverages statistical algorithms and machine learning techniques to identify patterns and trends, enabling accurate estimations of potential future needs, such as retirement savings requirements, investment portfolio performance, or even the impact of economic downturns. By understanding these fundamentals, individuals and financial institutions can make more informed decisions about their financial futures.

The core principle rests on the assumption that past behavior is a reliable indicator of future trends. However, it's crucial to acknowledge that predictive models are not perfect. External factors, unforeseen events, and the inherent complexity of financial markets can all introduce inaccuracies. Therefore, predictive models should be viewed as tools to enhance, not replace, human judgment and financial expertise.

Developing Accurate Financial Forecasts

Developing accurate financial forecasts requires careful consideration of various factors. Historical data, including income statements, expense records, and investment performance, are essential inputs. Choosing the right predictive model is also crucial. Simple models, like linear regression, might suffice for basic projections, while more complex algorithms, such as neural networks, may be necessary for more intricate financial scenarios, such as evaluating the impact of changing interest rates on mortgage payments or assessing the potential return on investments in a volatile market.

Leveraging AI for Enhanced Financial Planning

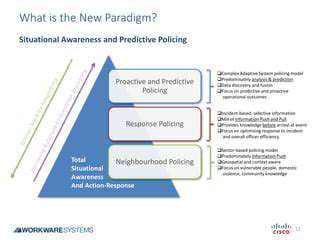

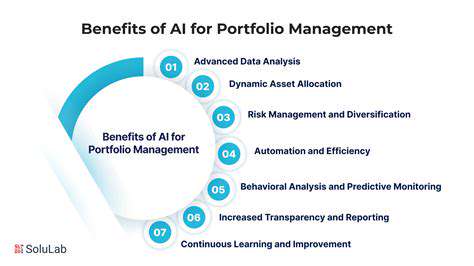

Artificial intelligence (AI) is revolutionizing financial planning by automating and enhancing the predictive modeling process. AI algorithms can analyze vast datasets, identify complex relationships, and generate more accurate forecasts than traditional methods. This capability allows for personalized financial plans tailored to individual circumstances and goals, ensuring that financial strategies are aligned with specific needs and aspirations.

Personalizing Financial Strategies with AI

AI-powered predictive modeling allows for the creation of highly personalized financial strategies. By considering individual factors like income, expenses, savings goals, and risk tolerance, AI can produce tailored projections. This personalization ensures that financial plans are not generic but rather bespoke solutions designed to address unique circumstances, maximizing the potential for achieving desired financial outcomes.

Integrating Predictive Models into Financial Platforms

Integrating predictive models into financial platforms is transforming how individuals and institutions manage their finances. Automated tools powered by AI can continuously monitor financial data, provide real-time insights, and adjust strategies as circumstances change. This integration empowers users with proactive financial management tools that anticipate potential challenges and opportunities, fostering informed decision-making and ultimately enhancing financial well-being.

Addressing the Challenges and Limitations of Predictive Modeling

While predictive modeling offers significant advantages, it's crucial to acknowledge its limitations. Model accuracy depends heavily on the quality and comprehensiveness of the data used for training. Unforeseen events and market fluctuations can render even the most sophisticated models inaccurate. Furthermore, interpreting complex AI-generated predictions requires careful analysis and consideration by financial professionals, ensuring that the outcomes are understood and appropriately acted upon.

Personalized Financial Roadmaps for Optimal Outcomes

Understanding Your Financial Landscape

Personalized financial roadmaps are crucial for achieving optimal outcomes, and the first step involves a deep understanding of your current financial situation. This includes analyzing income sources, expenses, assets, and liabilities. Accurate data collection is essential for building a roadmap that aligns with your unique circumstances and goals. A comprehensive financial assessment provides a clear picture of where you currently stand, identifying potential strengths and weaknesses, and allowing for informed decision-making.

Thorough analysis of your financial statements, including bank accounts, investment portfolios, and loan details, is vital. Understanding your spending habits and identifying areas for potential savings is also key. This process allows you to gain a clear perspective on your financial health and identify areas where you might need support or guidance.

Setting Realistic and Measurable Goals

Effective financial planning hinges on establishing clear, achievable, and measurable goals. These goals should reflect your aspirations, whether it's saving for a down payment on a house, funding your child's education, or achieving financial independence. Defining these goals with specific timelines and quantifiable targets is paramount for creating a roadmap that motivates you and keeps you on track.

Considering factors such as your desired lifestyle, family responsibilities, and potential career changes is crucial in setting realistic goals. These goals should inspire and challenge you while remaining grounded in practicality. This ensures that your financial roadmap is not just aspirational but also attainable.

Tailoring Strategies for Individual Needs

A one-size-fits-all approach to financial planning is rarely effective. AI-powered tools can analyze individual circumstances to tailor strategies that align with specific needs and preferences. By factoring in factors such as risk tolerance, investment goals, and time horizons, personalized strategies can be developed to optimize outcomes.

For example, someone with a high-risk tolerance and a long time horizon might opt for a more aggressive investment strategy compared to someone with a low-risk tolerance and a shorter time horizon. These tailored strategies will be more likely to achieve the desired outcomes for each individual.

Utilizing AI for Enhanced Planning

AI algorithms can process vast amounts of data to identify patterns and trends that might be missed by human analysts. This allows for more accurate predictions and customized recommendations. AI-powered tools can help you understand potential risks, evaluate investment options, and create detailed financial projections. These sophisticated tools can help you make more informed decisions and stay on track toward your goals.

Monitoring and Adjusting the Roadmap

Financial situations are dynamic, and circumstances can change. Regular monitoring and adjustments to your personalized roadmap are essential for maintaining optimal outcomes. AI-powered tools can track progress toward goals, identify potential roadblocks, and suggest adjustments to the plan. This ongoing monitoring ensures that the roadmap remains relevant and effective in the face of evolving circumstances.

Regular review and adjustments allow for flexibility and adaptation to unexpected changes, ensuring that your financial plan continues to support your needs and aspirations throughout your life. This proactive approach ensures that your financial journey remains aligned with your current goals and circumstances.

Embracing the Future of Financial Planning with AI

Embracing Technological Advancements

The financial sector is undergoing a rapid transformation, driven by the relentless march of technology. From sophisticated algorithms powering high-frequency trading to the rise of mobile banking apps, technology is fundamentally reshaping how we interact with and manage our finances. This evolution presents both exciting opportunities and considerable challenges for individuals and institutions alike.

The integration of artificial intelligence (AI) and machine learning (ML) is particularly noteworthy. These technologies are being leveraged to automate tasks, enhance risk management, and personalize financial products and services. This automation promises to improve efficiency and potentially reduce costs for financial institutions.

Navigating the Digital Frontier

The digital landscape is no longer a peripheral aspect of finance; it's become its very core. Embracing the digital frontier requires a proactive approach to cybersecurity and data privacy, ensuring that sensitive financial information is protected from malicious actors. Investing in robust security measures and staying informed about evolving threats are crucial in this digital age.

Furthermore, the accessibility of financial services is being significantly enhanced through digital platforms. This access is democratizing financial opportunities, potentially empowering underserved populations and fostering financial inclusion. However, digital literacy and financial education are critical for navigating this new landscape successfully.

The Role of Sustainability

Sustainability is no longer a niche concern; it's a critical factor influencing financial decision-making across the board. Investors are increasingly demanding that companies adopt sustainable practices, and responsible investment strategies are gaining significant traction. This growing emphasis on environmental, social, and governance (ESG) factors is redefining the very nature of financial success.

Financial institutions are now actively incorporating ESG considerations into their investment portfolios, reflecting a broader societal shift towards responsible practices. This evolution reflects a growing recognition that financial health is intrinsically linked to environmental and social well-being.

Adapting to Regulatory Changes

The regulatory environment is constantly evolving to address the challenges posed by technological advancements and changing market dynamics. Financial institutions must adapt to these evolving regulations to maintain compliance and operate within the bounds of the law.

Staying informed about and proactively responding to regulatory changes is essential for financial institutions to maintain their legitimacy and stability. This includes understanding and adhering to new guidelines related to data privacy, cybersecurity, and financial reporting.

Personal Financial Planning for the Future

Individuals need to proactively adapt their financial planning strategies in response to the rapidly evolving financial landscape. This involves staying informed about investment opportunities, understanding financial products, and developing a robust strategy for managing personal finances. Understanding the potential impact of technological advancements on your investment strategy is a key element of this adaptation.

Cultivating financial literacy and seeking guidance from qualified professionals can empower individuals to make informed decisions and navigate the complex financial world. This preparation is essential for long-term financial security and well-being in an ever-changing economic environment.