The Future of AI in Insurance Underwriting

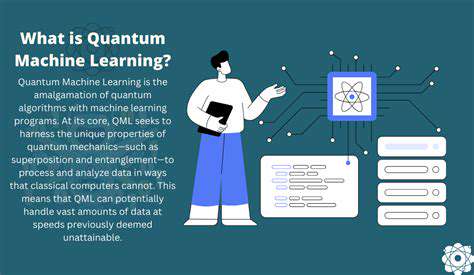

AI-Powered Risk Assessment

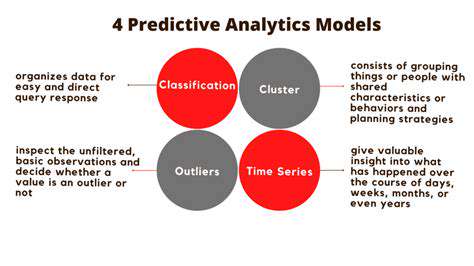

AI algorithms are revolutionizing insurance underwriting by analyzing vast datasets of customer information, including demographics, driving history, medical records, and even social media activity. This sophisticated risk assessment allows insurers to identify potential risks more accurately and efficiently than traditional methods. By identifying patterns and anomalies, AI can flag individuals or situations with higher risk profiles, leading to more precise pricing and tailored coverage options.

Personalized Pricing and Coverage

Traditional insurance pricing often relies on broad demographic factors, leading to potentially unfair or inaccurate premiums. AI enables insurers to tailor premiums and coverage options to individual needs and risk profiles. This personalized approach leads to more equitable pricing and increases customer satisfaction by offering products that better match specific situations.

For example, a driver with a spotless driving record and a low-risk medical history could qualify for a lower premium than a driver with a history of accidents, demonstrating a clear advantage of AI in insurance.

Enhanced Fraud Detection

AI can analyze vast amounts of transactional data to identify unusual patterns that may indicate fraudulent activity. This proactive approach to fraud detection allows insurers to take swift action to prevent financial losses and maintain trust within the market. Sophisticated machine learning models can detect anomalies and suspicious transactions that might otherwise go unnoticed by traditional methods.

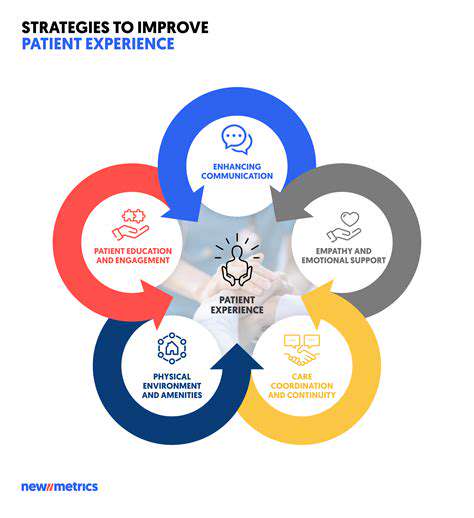

Improved Customer Experience

AI-powered chatbots and virtual assistants can streamline the insurance application process, providing customers with instant support and answers to their questions. This leads to a more seamless and efficient experience, reducing wait times and improving overall customer satisfaction. Faster processing times and 24/7 accessibility significantly improve the user experience.

Streamlined Claims Processing

AI can automate many aspects of claims processing, such as verifying documentation and assessing damages. This automation reduces processing time, minimizes human error, and allows claims adjusters to focus on more complex cases. An efficient claims process is crucial for maintaining customer satisfaction and providing a positive experience during a potentially stressful period.

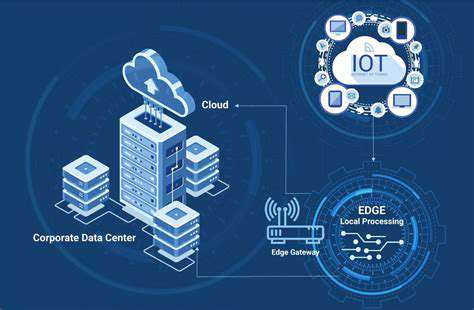

Data Security and Privacy Concerns

The use of AI in insurance underwriting necessitates robust data security and privacy measures. Insurers must ensure that sensitive customer information is protected from unauthorized access and breaches. Strong encryption and compliance with data privacy regulations are essential to build trust and maintain customer confidence. Addressing these concerns proactively is vital for long-term success in the AI-driven insurance market.

The Future of Underwriting

AI is poised to fundamentally transform the insurance underwriting landscape, driving greater efficiency, accuracy, and personalization. As AI technology continues to evolve, we can expect even more sophisticated applications in the future, leading to more effective risk assessment, improved customer experiences, and a more dynamic insurance industry. This forward-thinking approach will remain crucial to navigating the future and adapting to changing market demands.