Understanding the Context

Delving into the intricate world of data analysis often involves more than simply crunching numbers. A crucial aspect of effective analysis is understanding the context surrounding those figures. This context encompasses the environment in which the data was collected, the methodologies employed, and the potential biases that might have influenced the results. Without this contextual understanding, even seemingly significant numerical trends can be misleading.

Considering the historical trends and the current economic climate, for example, provides a more complete picture than simply looking at the raw numbers. This broader perspective allows for a more nuanced interpretation of the data, leading to more accurate insights and informed decision-making.

Identifying Patterns and Trends

While raw data can be overwhelming, the key to unlocking its value lies in identifying patterns and trends. These patterns often reveal hidden insights that can be leveraged to make significant improvements in various areas. Careful examination of the data can uncover correlations between different variables, providing a clearer picture of how various factors interact and influence one another.

For instance, observing a steady increase in sales figures over several quarters might indicate a positive market response to a new product launch or marketing campaign. Analyzing the data with a keen eye for these subtle trends is crucial to understanding the underlying forces driving the observed outcomes.

Drawing Meaningful Conclusions

Transforming raw data into actionable insights demands a meticulous approach to interpreting the results. Simply presenting a collection of numbers isn't sufficient; the data must be examined critically, and conclusions must be drawn with precision and care. Drawing conclusions that are both logical and well-supported by the evidence is paramount.

Careful consideration of potential outliers and anomalies is vital in this process. These deviations from the norm can sometimes provide valuable clues about specific circumstances or unique situations that might be influencing the overall trends. Ignoring these nuances can lead to inaccurate conclusions and flawed decision-making.

Applying Insights to Action

The ultimate goal of data analysis is to translate insights into tangible actions. This requires a thorough understanding of how the data can be applied to solve problems and achieve specific objectives. A well-defined plan of action, built upon the insights gleaned from the data analysis, is essential for maximizing the impact of the findings.

For example, if the analysis reveals a strong correlation between customer demographics and purchasing behavior, businesses can tailor their marketing strategies to specific segments, leading to improved customer engagement and potentially higher conversion rates. Effective implementation of these strategies is critical to realizing the full potential of the data.

This recipe emphasizes a quick and easy preparation method, perfect for weeknight meals. The one-pan aspect significantly reduces cleanup time, making it ideal for busy schedules. The combination of flavors, expertly balanced, creates a delicious and satisfying experience. The simplicity of the dish allows you to focus on other aspects of your day while still enjoying a healthy and flavorful meal. This technique effectively seals in the juices of the salmon, ensuring a tender and succulent result.

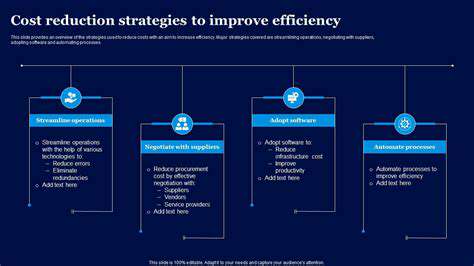

Automated Strategies for Enhanced Efficiency

Defining the Role of Automation

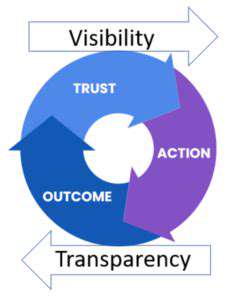

Automated strategies in financial planning are crucial for optimizing efficiency and accuracy, particularly in a complex and rapidly evolving financial landscape. These strategies utilize algorithms and machine learning to analyze vast datasets, identify patterns, and provide actionable insights, freeing up valuable time and resources for financial advisors. Automation streamlines repetitive tasks, such as data entry and report generation, allowing for more focused attention on personalized client interactions and strategic planning.

By automating routine processes, financial planning firms can significantly reduce the risk of human error and ensure consistent application of best practices across all client portfolios. This consistency is paramount for building trust and maintaining a high level of service quality, a key differentiator in today's competitive market.

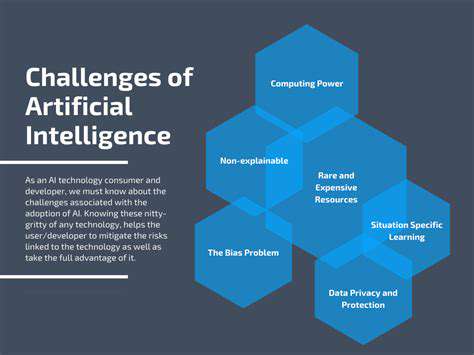

Optimizing Processes through AI

AI-powered tools are transforming financial planning by automating tasks that were once time-consuming and labor-intensive. From assessing risk tolerance to projecting future financial needs, algorithms can analyze individual circumstances and provide tailored recommendations, far exceeding the capabilities of manual analysis. This personalized approach leads to more effective and efficient financial strategies, tailored to the specific goals and circumstances of each client.

The application of AI extends beyond basic calculations. Sophisticated algorithms can identify market trends and economic indicators, enabling proactive adjustments to investment portfolios. This predictive capability allows for a more dynamic and responsive approach to financial planning, positioning clients for success in fluctuating markets.

Tailoring Strategies for Enhanced Results

The key to effective automation in financial planning lies in its ability to adapt to individual client needs. By creating customized financial personas, AI can analyze a client's unique situation, including income, expenses, goals, and risk tolerance, to develop personalized strategies.

This personalized approach is crucial for maximizing returns and ensuring clients' financial well-being. Through ongoing monitoring and adaptation, AI-powered systems can adjust strategies in real-time, ensuring clients stay on track toward their financial objectives, and helping them navigate the complexities of the ever-changing financial world.

This iterative approach to financial planning allows for a proactive and dynamic response to evolving circumstances, ultimately leading to more effective and satisfying outcomes for clients. The integration of AI in financial planning represents a significant step towards a more efficient, personalized, and ultimately, more successful financial future.

Furthermore, the ability to continuously analyze and refine strategies based on real-time data allows for a higher degree of accuracy and adaptability, crucial in today's dynamic economic environment. This iterative approach, powered by AI, ensures that financial planning remains relevant and effective.

Ultimately, these automated strategies empower financial advisors to focus on the human element of financial planning, fostering stronger client relationships and providing unparalleled value.

The Future of Wealth Management: AI as a Partner

AI-Driven Portfolio Optimization

Artificial intelligence is poised to revolutionize portfolio optimization, moving beyond simple rules-based systems to dynamically adapt to evolving market conditions. AI algorithms can analyze vast amounts of data, including market trends, economic indicators, and individual investor risk profiles, to create highly personalized and optimized portfolios. This level of sophisticated analysis, far exceeding human capability, allows for more precise risk management and potentially higher returns, while considering individual investor goals and timelines.

This dynamic adaptation is critical, as market conditions fluctuate constantly. AI's ability to learn and adjust in real-time means portfolios can be rebalanced automatically, mitigating potential losses and maximizing gains. This is a significant advancement over traditional methods, where rebalancing often requires human intervention and can lead to missed opportunities or delayed adjustments.

Personalized Financial Advice

AI-powered chatbots and virtual assistants are already transforming the way financial advice is delivered, offering instant access to personalized guidance and support. These tools can answer basic financial questions, provide investment recommendations, and even track progress toward financial goals, all within a user-friendly interface.

Imagine a system that understands your unique financial situation, your aspirations, and your risk tolerance, and proactively suggests adjustments to your strategy. This level of personalized attention, previously only available to high-net-worth individuals, is now becoming accessible to everyone with an internet connection.

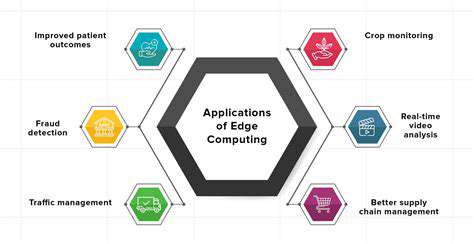

Enhanced Fraud Detection and Security

AI is becoming increasingly adept at identifying fraudulent activities in financial transactions. By analyzing patterns and anomalies in user behavior and transaction data, AI systems can detect suspicious activities and flag them for review, significantly reducing the risk of financial fraud. This proactive approach to security strengthens the overall financial ecosystem by protecting individuals and institutions from malicious actors.

The use of AI in security goes beyond basic fraud detection. It can also identify and mitigate emerging threats, adapting to new fraud tactics in real time. This constant learning ability is crucial in the ever-evolving landscape of financial crime.

Automated Tax Preparation and Management

AI can streamline the tax preparation process, handling complex calculations and ensuring accuracy. By automating the collection and organization of financial data, AI tools can significantly reduce the time and effort required for tax compliance. This automation will benefit both individuals and businesses, allowing them to focus on other aspects of their financial planning and management.

Improved Risk Assessment and Management

AI algorithms can analyze a vast amount of data, identifying patterns and trends that may indicate potential risks to investments. This analysis goes beyond traditional methods, offering a more comprehensive and nuanced understanding of risk factors. By understanding risk in a more detailed and thorough way, AI systems can help individuals and institutions make more informed decisions, mitigate potential losses, and ultimately achieve better investment outcomes.

Predictive Analytics for Investment Strategies

AI's predictive capabilities are revolutionizing investment strategies, allowing for more informed decision-making based on anticipated market movements. By analyzing historical data and current market trends, AI models can identify potential investment opportunities and predict potential outcomes, enabling more strategic and potentially higher-yielding investment decisions.

These predictive models can identify emerging trends and market shifts, allowing for proactive adjustments to investment portfolios, which can be critical in navigating volatile market conditions.

Accessibility and Democratization of Finance

AI-powered financial tools are breaking down barriers to entry in the world of finance, making sophisticated investment strategies and personalized advice accessible to a wider range of individuals. This democratization of finance empowers individuals to take control of their financial future, regardless of their background or financial resources.

By lowering the barrier to entry, AI fosters greater financial literacy and participation, ultimately contributing to a more equitable and prosperous financial landscape for all.