Technological Considerations and Implementation Strategies

Security Considerations for a CBDC

Implementing a Central Bank Digital Currency requires multilayered security protocols to prevent fraud and cyber threats. Advanced security measures should include robust encryption, secure transaction processing, and strong authentication systems. These protections must evolve to counter emerging threats while maintaining system reliability. Continuous risk assessment is vital for identifying and addressing potential vulnerabilities before they can be exploited.

The security architecture must accommodate future expansion and changing operational needs. This includes implementing sophisticated fraud detection systems, real-time transaction monitoring, and comprehensive incident response plans. Building public confidence in CBDC security remains paramount for successful adoption.

Infrastructure Development and Scalability

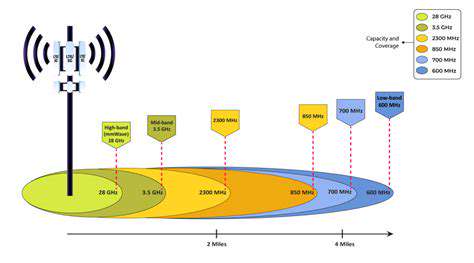

CBDC infrastructure development requires meticulous planning. Designers must create reliable payment systems, establish secure communication networks, and ensure compatibility with existing financial infrastructures. The system must handle peak transaction volumes and accommodate growing user bases without performance degradation.

Scalability represents a critical design consideration. The CBDC system must support increasing transaction loads and user expansion while maintaining security and efficiency. This requires thoughtful architectural decisions, technological innovation, and continuous system maintenance.

Interoperability and Integration with Existing Systems

Successful CBDC implementation depends on seamless integration with current financial systems. The digital currency must interact smoothly with banking infrastructures and payment networks to minimize transition disruptions. Achieving this integration requires close collaboration with financial institutions and other stakeholders.

Regulatory Framework and Legal Considerations

A well-defined legal framework is essential for CBDC success. This includes establishing the digital currency's legal status, defining user rights and responsibilities, and creating transaction processing guidelines. The framework must address compliance requirements, tax implications, and potential conflicts with existing financial regulations.

User Adoption and Education

Public acceptance and understanding are crucial for CBDC implementation. Effective communication strategies must clearly explain the digital currency's benefits and functionality. User-friendly interfaces and educational resources can facilitate adoption, while addressing public concerns helps build trust. A phased implementation approach combined with comprehensive education campaigns may ease the transition.

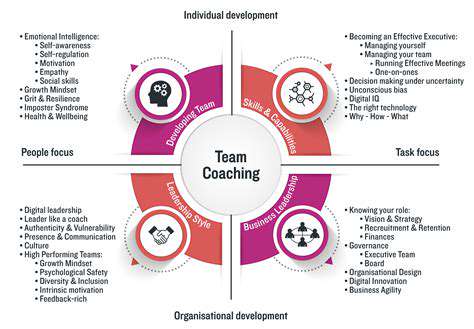

Public-Private Partnerships and Collaboration

Successful CBDC development often benefits from public-private cooperation. Private sector expertise in technology, infrastructure management, and user experience design can complement central bank oversight. Such partnerships may enhance efficiency, foster innovation, and optimize implementation costs. Collaboration between various stakeholders helps navigate CBDC implementation complexities.

Global Landscape and Regulatory Frameworks

Global Landscape of Regulatory Frameworks

The international regulatory environment consists of diverse national and international laws that create a complex compliance landscape for global businesses. Variations in regulatory approaches significantly influence corporate strategies and compliance expenditures. Different jurisdictions maintain distinct perspectives on data protection, intellectual property, and environmental regulations, creating multiple considerations for multinational operations.

International organizations play a key role in shaping global standards, attempting to harmonize regulations across borders. However, implementation varies considerably, requiring businesses to develop nuanced understanding of both domestic and international requirements. This dual understanding is essential for maintaining compliance in multiple jurisdictions.

Regulatory Frameworks and Technological Advancements

Emerging technologies continuously reshape regulatory requirements. Innovations like artificial intelligence and blockchain present new regulatory challenges that demand adaptive frameworks. Balancing technological innovation with security, privacy, and ethical considerations represents a significant regulatory challenge. Policymakers must collaborate with industry experts to develop appropriate regulatory responses.

Novel regulatory approaches, including regulatory sandboxes and agile policymaking, are emerging to address technological innovation. These methods aim to support technological advancement while managing associated risks. Such innovative regulatory models help businesses navigate evolving compliance landscapes.

Regulatory Fragmentation and Harmonization Efforts

Divergent national regulations create challenges for global business operations, potentially increasing compliance costs and creating inconsistencies. Addressing this fragmentation remains a priority for international organizations and multinational corporations alike. Harmonization initiatives seek to create more uniform international standards across various regulatory domains.

International cooperation plays a vital role in regulatory harmonization efforts. Collaborative agreements aim to establish common standards for data protection, intellectual property, and environmental regulations. Such harmonization can facilitate international trade while creating a more predictable regulatory environment.