Decentralized Identity Management and KYC Compliance

Decentralized Identity Management: A Paradigm Shift

The financial sector faces particularly acute identity challenges, with Know Your Customer (KYC) requirements creating friction for both institutions and clients. Decentralized approaches offer a compelling alternative to the current model of repetitive documentation submission. This evolution mirrors broader digital transformation trends across industries.

By implementing reusable digital credentials, banks could reduce customer onboarding costs by up to 80% while simultaneously improving compliance. The efficiency gains alone make this transition inevitable for forward-thinking institutions.

Key Components of DIM

Modern implementations combine several groundbreaking technologies. Distributed ledgers provide the backbone, while zero-knowledge proofs enable verification without exposing sensitive data. These cryptographic techniques allow for revolutionary privacy-preserving verification methods.

Benefits of DIM for Users

For consumers, the advantages extend beyond convenience. Imagine controlling exactly which pieces of your identity each service can access, with the ability to instantly revoke permissions. This level of granular control represents a fundamental shift in the balance of power between individuals and organizations.

Security Enhancements in DIM

The security model represents a complete inversion of traditional approaches. Rather than institutions becoming targets because they aggregate valuable data, decentralized systems distribute risk. Even if one node is compromised, the overall system remains secure - a property known as Byzantine fault tolerance.

Scalability and Interoperability in DIM

Emerging standards like W3C's DID specification aim to solve the interoperability challenge. These frameworks enable different systems to communicate while preserving each platform's unique features. The resulting network effects could create an identity ecosystem as universal as email or web browsing.

Challenges in Implementing DIM

Regulatory acceptance remains a significant barrier. While the technology matures, policymakers struggle to adapt century-old legal frameworks to these new paradigms. Education initiatives targeting both regulators and financial institutions will be critical for smooth adoption.

Future of DIM

The long-term implications are profound. We're witnessing the early stages of a complete rearchitecture of digital trust systems. Within a decade, the current patchwork of usernames, passwords, and document scans may seem as antiquated as paper ledgers do today.

Enhanced AML Processes with Blockchain Technology

Improving KYC/AML Compliance with Decentralized Identity

Anti-money laundering efforts face growing challenges in our interconnected financial systems. Blockchain-based solutions introduce game-changing capabilities through their inherent transparency and immutability. These properties enable new approaches to transaction monitoring that were previously impossible.

Securing Transaction History with Immutable Records

The forensic potential of blockchain transaction trails represents a paradigm shift for investigators. Every movement of funds leaves an indelible mark that can be followed across jurisdictions and institutions. This creates unprecedented visibility into financial flows while actually enhancing privacy through pseudonymous addressing.

Future Trends and Challenges

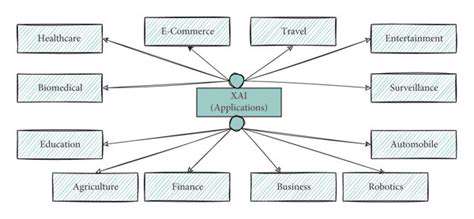

The Rise of AI in Everyday Tasks

As AI capabilities advance, we're seeing a shift from narrow applications to more generalized assistance. These tools aren't just automating tasks - they're developing the ability to understand context and intent, enabling more natural and productive human-machine collaboration.

Sustainability and Environmental Concerns

The environmental impact of emerging technologies deserves careful consideration. While blockchain has faced criticism for energy use, newer consensus mechanisms are achieving security with minimal carbon footprint. Sustainable technological development must balance innovation with environmental responsibility.

Cybersecurity Threats and Data Privacy

The security landscape continues to evolve rapidly. Decentralized systems introduce new defense mechanisms, but also create novel attack surfaces. Ongoing research into post-quantum cryptography will be essential as computing power increases.

The Impact of Emerging Technologies

We're entering an era where multiple disruptive technologies converge. The combination of decentralized identity with AI analytics and IoT devices will create entirely new categories of applications. Organizations that can navigate this complexity will unlock tremendous value in the coming decade.