Beyond Backtesting: Incorporating Real-World Factors in Strategy Development

Understanding the Limitations of Backtesting

Backtesting, while a crucial initial step in strategy development, often falls short in accurately predicting real-world performance. It relies on historical data, which may not reflect future market conditions, and often fails to account for critical factors such as changes in market sentiment, regulatory shifts, or unforeseen economic events. This inherent limitation necessitates a more nuanced approach to strategy development that incorporates real-world elements.

Furthermore, backtesting often overlooks the impact of transaction costs, slippage, and the potential for human error in execution. These real-world considerations can significantly erode the theoretical returns observed in backtesting simulations, making it essential to move beyond this simplified representation.

The Role of Risk Management in Real-World Strategies

Risk management is paramount in any investment strategy, particularly when moving beyond backtesting. A robust risk management framework should consider potential downside scenarios and incorporate stop-loss orders, position sizing strategies, and diversification techniques to mitigate the impact of adverse market movements. Careful consideration of risk tolerance and investment goals is paramount in creating a strategy that aligns with the investor's individual needs and risk appetite.

Incorporating Market Sentiment Analysis

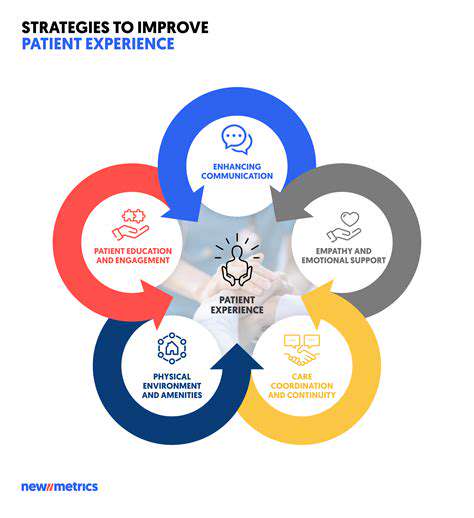

Market sentiment, often overlooked in backtesting, plays a significant role in real-world market fluctuations. Utilizing sentiment analysis tools and techniques allows for a deeper understanding of investor psychology and collective market mood. This information can provide valuable insights into potential market turning points and inform adjustments to trading strategies.

By understanding the collective emotional state of investors, traders can anticipate potential shifts and adjust their strategies accordingly, which is often absent in the purely historical data-driven approach of backtesting.

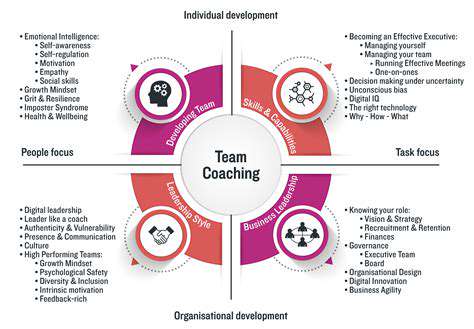

Integrating Fundamental and Technical Analysis

A comprehensive strategy should leverage both fundamental and technical analysis. Fundamental analysis delves into the intrinsic value of assets, considering factors such as company financials, industry trends, and macroeconomic conditions. Technical analysis examines historical price patterns and volume data to identify potential trading opportunities. Combining these approaches provides a more holistic view of market dynamics and enhances the decision-making process.

This integrated approach often leads to more informed and resilient investment strategies, providing a more robust framework than a purely technical or fundamental analysis approach, both of which can be incomplete.

Adapting Strategies to Changing Market Conditions

Real markets are dynamic entities. Strategies need to be adaptable and responsive to unforeseen events and shifts in market conditions. This includes the ability to adjust position sizes, trading frequencies, and even the underlying assets held within a portfolio. Flexibility and responsiveness are crucial characteristics of successful strategies.

Regular monitoring and evaluation are essential, allowing for timely adjustments to maintain alignment with evolving market conditions. This dynamic approach is often lacking in backtesting, which relies on a static historical environment.

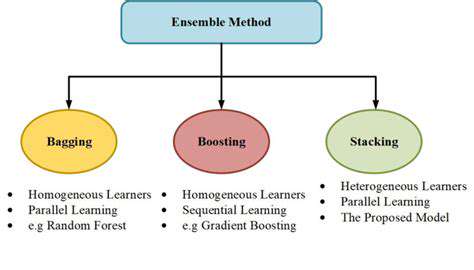

Utilizing AI and Machine Learning for Enhanced Insights

Artificial intelligence (AI) and machine learning (ML) can be powerful tools in strategy development, enabling the analysis of vast datasets and the identification of complex patterns that may be missed by traditional methods. AI can help identify emerging trends, predict market movements, and optimize trading algorithms.

AI-driven insights can significantly enhance the accuracy and effectiveness of strategies. Incorporating AI allows for a more sophisticated understanding of market behavior and facilitates the development of more adaptive and profitable strategies.

Backtesting as a Component, Not the Goal

While backtesting remains a valuable initial step, it should be viewed as a component of a broader strategy development process, not the ultimate goal. Integrating real-world factors, such as risk management, sentiment analysis, and adaptive strategies, is crucial for creating robust and profitable investment strategies.

Ultimately, the focus should shift from solely relying on historical data to actively engaging with the dynamic nature of real-world markets. This approach leads to more sustainable and successful investment strategies in the long run.