Decentralization and Trust

Decentralized ownership, at its core, shifts the traditional power dynamic from centralized entities to distributed networks. This paradigm shift fundamentally alters the way assets are managed, governed, and accessed. Instead of relying on intermediaries like banks or corporations, decentralized systems leverage blockchain technology to empower individuals with direct control over their assets. This fosters greater trust and transparency, as ownership records are immutable and publicly verifiable.

Tokenization as a Catalyst

Tokenization plays a crucial role in enabling decentralized ownership. By representing real-world assets, such as real estate, art, or intellectual property, as digital tokens on a blockchain, these assets become more accessible and liquid. Tokenization facilitates fractional ownership, allowing individuals to acquire a portion of an asset without needing to invest substantial capital.

Improved Asset Liquidity

Tokenized assets often exhibit greater liquidity than their traditional counterparts. The blockchain's inherent transparency and efficiency enable faster and more secure transactions. This increased liquidity makes it easier for owners to buy, sell, or trade their fractional ownership without facing the complexities and delays associated with traditional asset transfer mechanisms. This enhanced liquidity is a significant advantage for investors and asset holders.

Enhanced Security and Transparency

Blockchain's immutability and cryptographic security features enhance the security of tokenized assets. Records of ownership are permanently recorded on the distributed ledger, making them virtually tamper-proof. This inherent transparency ensures that all transactions are verifiable and auditable, eliminating the risk of fraud or manipulation. The immutable record also significantly strengthens trust among participants.

Fractional Ownership and Accessibility

Decentralized ownership facilitates fractional ownership, making assets accessible to a wider range of individuals. This democratization of investment opportunities allows for greater participation in markets that were previously exclusive. Small investors can now potentially participate in ventures or acquire fractional ownership of valuable assets without the need for substantial upfront capital investments. This is a powerful democratizing force in the financial world.

Governance and Control

Decentralized ownership often involves establishing smart contracts that automate governance and control over assets. These self-executing agreements define rules and permissions for asset management, ensuring that all participants adhere to predetermined guidelines. This automated governance model eliminates the need for intermediaries and allows for a more streamlined and efficient management of assets, reducing administrative overhead and ensuring consistency.

Potential for Disruption

The paradigm shift towards decentralized ownership has the potential to disrupt traditional financial systems and asset management models. This disruption could lead to more efficient and transparent markets, increased accessibility to investment opportunities, and greater empowerment of individuals. However, challenges such as regulatory frameworks and widespread adoption need to be addressed for the full potential of decentralized ownership to be realized.

Fractional Ownership and Enhanced Liquidity

Fractional Ownership: Democratizing Asset Access

Fractional ownership, facilitated by tokenization, allows individuals to own a portion of an asset, be it a real estate property, a valuable artwork, or even a physical commodity, without needing the substantial capital typically required for full ownership. This democratizes access to high-value assets, making them more accessible to a wider range of investors, fostering greater participation and market liquidity.

Imagine a collector wanting to own a piece of a renowned painting but not having the resources for the whole piece. Tokenization allows them to acquire a fractional ownership token, effectively giving them a share in the artwork's appreciation and any potential future gains. This makes investment opportunities more inclusive and opens doors to previously exclusive markets.

Enhanced Liquidity: Revolutionizing Asset Trading

Tokenization significantly enhances the liquidity of assets. Traditional assets often have limited trading opportunities, particularly those with complex ownership structures. By tokenizing these assets, they can be divided into smaller, tradable units, increasing the frequency and volume of transactions. This increased liquidity creates a more vibrant market, allowing investors to buy and sell fractions of assets more easily and efficiently. This translates into potentially higher returns and greater market efficiency.

The ability to tokenize and trade fractional ownership creates a more active and liquid market for previously illiquid assets. Investors can now participate in the gains of assets like real estate, fine art, or even rare collectibles without the large initial capital outlay or the complexities of traditional ownership structures. This fosters greater market participation and potentially higher returns for all involved.

Improved Asset Management and Transparency

Tokenization platforms often incorporate robust management tools and provide transparent records of ownership. These tools allow for streamlined management of fractional ownership, facilitating easy tracking of ownership, distributions of earnings, and other crucial aspects of asset management. This level of transparency is a significant advancement from traditional asset management methods, improving accountability and investor confidence.

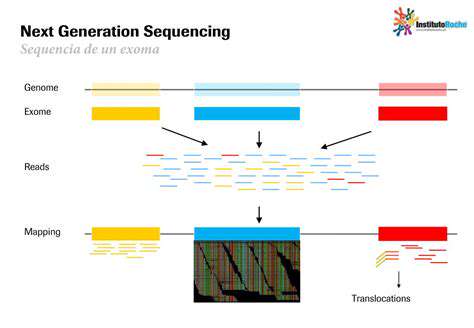

Blockchain's Role in Security and Efficiency

Blockchain technology, the foundation of tokenization, plays a crucial role in ensuring security and efficiency. Its immutability and decentralized nature make it a robust platform for recording and verifying ownership, reducing the risk of fraud and enhancing trust in the system. This translates to a more secure and efficient process for managing assets, reducing the need for intermediaries and streamlining transactions. This secure and efficient system ensures the legitimacy of ownership and reduces the risk of disputes. The inherent security and transparency of blockchain further strengthens investor confidence in the tokenized asset.

Optimizing training frequency is crucial for muscle growth. Consistent, targeted workouts are more effective than sporadic, intense sessions. A well-structured program should allow for adequate recovery between workouts, enabling the muscles to repair and rebuild stronger. Proper volume, meaning the total amount of work performed, is also vital. Increasing the volume gradually over time is essential to challenge the muscles and promote hypertrophy (muscle growth).

Beyond Traditional Assets: The Expanding Scope

Beyond Traditional Assets: Exploring Alternative Investments

Alternative investments are increasingly attracting attention from investors seeking diversification and potentially higher returns beyond the traditional asset classes of stocks and bonds. These investments often include a wider range of options, including real estate, commodities, private equity, and hedge funds. Understanding the nuances of these investments is crucial for making informed decisions, and a comprehensive approach to research and due diligence is vital. This diversification can help mitigate risk in a portfolio by providing exposure to different market cycles and economic factors.

These alternative investments can offer unique opportunities for growth, but they also come with their own set of risks. Investors need to be mindful of the potential for illiquidity, limited transparency, and higher volatility compared to more established asset classes. Thorough research and a clear understanding of the specific investment vehicle's characteristics are essential to effectively manage these risks.

Real Estate Investment Trusts (REITs): A Deep Dive

Real estate investment trusts (REITs) offer a way to invest in real estate without directly owning properties. REITs are companies that own or finance income-producing real estate, such as apartments, office buildings, and shopping malls. By pooling investor capital, REITs can invest in a broader range of properties, spreading risk and potentially offering higher returns compared to individual property ownership.

REITs often distribute a significant portion of their earnings to shareholders in the form of dividends, providing a steady income stream. However, the performance of REITs can be influenced by macroeconomic factors such as interest rates and economic growth. Investors should carefully consider the specific characteristics of different REITs and their exposure to various market forces.

Commodities: Fluctuations and Opportunities

Investing in commodities, like gold, oil, and agricultural products, presents a unique opportunity to hedge against inflation and diversify a portfolio. Commodities often exhibit different price movements than traditional assets, providing potential for diversification and mitigating risk. Understanding the complex dynamics of commodity markets and their global influences is crucial for success. The volatile nature of commodity markets, however, necessitates careful consideration of the potential for significant price fluctuations.

The prices of commodities can be influenced by numerous factors, including global supply and demand, geopolitical events, and weather patterns. This makes them a complex area for investment, requiring a high level of understanding and potentially a sophisticated investment strategy. Investment in commodities requires careful consideration of the potential for significant price fluctuations.

Private Equity: Navigating the Labyrinth

Private equity investments, such as venture capital and leveraged buyouts, offer the potential for substantial returns but often require a longer time horizon and a higher degree of due diligence. These investments involve investing in privately held companies, often with a focus on growth and restructuring. Investors must be prepared to navigate the complexities of private company valuations and deal structures.

Due diligence and thorough research are paramount when considering private equity investments, as these investments often carry a higher degree of risk associated with illiquidity and limited transparency. It's important to carefully assess the potential risks and rewards before committing capital to private equity.