AI Techniques for Detecting Capital Market Fraud

Deep Learning Architectures for Capital Detection

Modern financial institutions increasingly rely on deep learning models like convolutional neural networks (CNNs) and recurrent neural networks (RNNs) to identify irregularities in capital markets. These sophisticated systems demonstrate remarkable proficiency in analyzing textual patterns, enabling precise differentiation between various capitalization formats. CNNs prove invaluable for recognizing spatial relationships in financial documents, while RNNs handle sequential financial data with exceptional capability.

The training methodology incorporates extensive datasets of financial documentation, allowing models to master the subtle nuances of capitalization standards. Advanced approaches such as transfer learning accelerate this process, where pre-existing models undergo refinement for specific financial detection tasks. This adaptation enables the system to build upon established knowledge while customizing to particular dataset characteristics.

Natural Language Processing (NLP) Techniques

Traditional NLP methodologies complement modern detection systems in financial analysis. Techniques including part-of-speech identification contribute substantially to recognizing proper nouns and specialized financial terminology. Such grammatical analysis enhances detection precision significantly when examining corporate disclosures and market reports.

Lexical examination techniques, which analyze word relationships within financial contexts, provide additional support. By evaluating frequency patterns and contextual usage, algorithms can establish capitalization conventions specific to financial markets. This methodology offers valuable insights into the specialized formatting requirements of financial documentation.

Rule-Based Systems for Capitalization

Explicit rule-based frameworks present an alternative approach to financial text analysis. These systems implement defined protocols for formatting requirements, such as initial word capitalization in statements or proper naming conventions. While developing comprehensive rule sets demands considerable effort, the resulting precision justifies the investment when dealing with standardized financial documentation.

The adaptability of rule-based systems proves particularly advantageous for specialized financial sectors with unique formatting requirements. This flexibility ensures compliance with industry-specific standards that may diverge from general language conventions.

Ensemble Methods for Enhanced Accuracy

Combining multiple analytical approaches through ensemble techniques yields superior results in financial document examination. Integrating outputs from diverse methodologies, including deep learning models and rule-based systems, creates a more comprehensive evaluation framework. This synergistic approach captures the full spectrum of capitalization nuances in financial texts.

Ensemble systems typically employ consensus mechanisms to reconcile predictions from individual components. This collaborative decision-making process minimizes individual errors and produces more dependable final assessments.

Data Preprocessing and Feature Engineering

Successful financial text analysis depends fundamentally on input data quality. Essential preprocessing steps include noise reduction, handling incomplete entries, and standardizing document formats. These measures ensure data consistency and minimize analytical inaccuracies.

Strategic feature selection further enhances model performance in financial contexts. Parameters such as term length, sentence position, and contextual relationships provide additional decision-making criteria. Incorporating these elements leads to improved analytical accuracy and deeper understanding of financial formatting conventions.

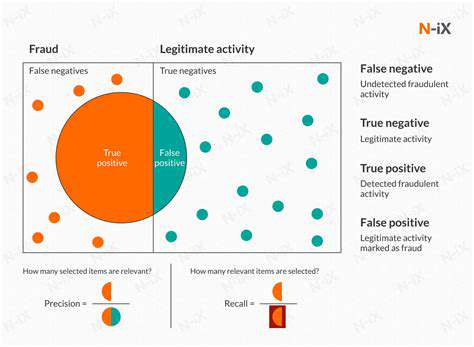

Evaluating Capital Detection Models

Performance assessment remains critical for maintaining analytical effectiveness in financial markets. Standard metrics including precision measurements, recall rates, and composite scores quantify model accuracy in identifying proper formatting. These indicators provide clear benchmarks for system performance.

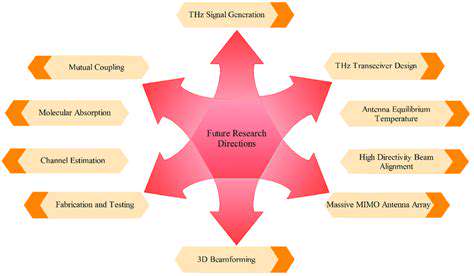

Comparative analysis across different models, datasets, and financial contexts proves essential for selecting optimal solutions for specific applications. Thorough evaluation of model capabilities and limitations informs continuous improvement strategies and future development directions.

Future Trends and Challenges in AI-Powered Fraud Detection

Evolving Fraudulent Tactics

As detection systems grow more advanced, financial criminals continuously develop increasingly sophisticated evasion techniques. This dynamic landscape demands perpetual system updates and refinements to recognize novel fraudulent patterns. The escalating complexity and volume of global financial transactions compounds the challenge of identifying emerging fraudulent schemes.

Emerging threats like synthetic identities and advanced digital forgeries circumvent conventional verification protocols, necessitating multi-layered authentication approaches. This technological escalation creates an ongoing innovation imperative for financial security systems.

Advancements in Machine Learning Algorithms

The evolution of fraud detection technology depends on progressive developments in analytical methodologies. Cutting-edge techniques including deep neural networks and adaptive learning systems demonstrate enhanced capability to identify subtle irregularities in massive financial datasets. These approaches reveal complex patterns often overlooked by conventional analysis methods.

Interpretable AI systems gain increasing importance for establishing model transparency. Understanding detection rationale proves essential for regulatory compliance and maintaining customer confidence in financial institutions.

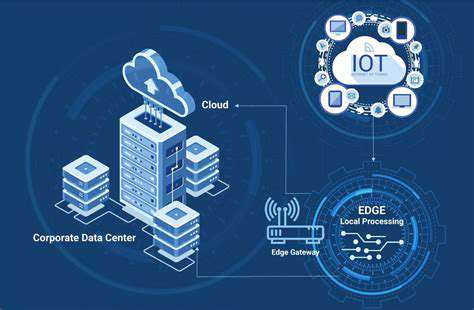

The Role of Big Data and Real-Time Processing

The exponential growth of financial data presents both opportunities and obstacles for security systems. Effective fraud prevention requires instantaneous analysis of vast transaction volumes, demanding substantial computational resources and optimized analytical algorithms.

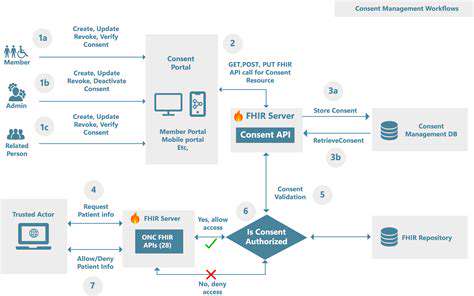

Integration with Other Security Systems

Comprehensive financial protection requires seamless integration between detection systems and broader security infrastructure. This unified approach enables comprehensive threat assessment across multiple financial channels, creating robust defense mechanisms against fraudulent activity.

The Importance of Data Privacy and Security

Protecting sensitive financial information remains paramount in fraud prevention systems. Implementing rigorous data protection measures and compliance with privacy regulations maintains system integrity and public confidence in financial security measures.

Addressing Bias and Fairness in AI Models

Potential algorithmic biases in financial analysis systems raise significant ethical concerns. Ensuring equitable outcomes requires careful dataset selection, unbiased algorithm development, and continuous performance monitoring across diverse demographic groups.

Overcoming the Challenge of Scalability

Global implementation of fraud detection systems presents substantial scaling difficulties. Adapting solutions to diverse regional financial environments while managing escalating transaction volumes necessitates robust infrastructure and ongoing system optimization.