Introduction to Algorithmic Trading

Understanding Algorithmic Trading

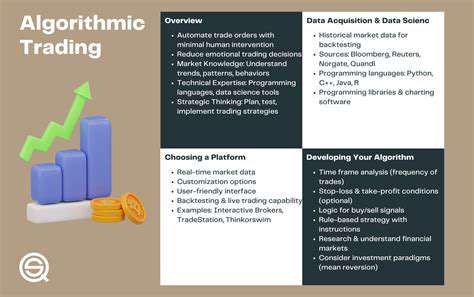

Algorithmic trading, also known as automated trading, is a method of executing trades in financial markets using pre-programmed instructions. These instructions, based on specific criteria and strategies, dictate when and how to buy or sell securities. This approach contrasts with traditional, human-driven trading, where decisions are often influenced by subjective factors. Algorithmic trading has revolutionized the financial industry, enabling faster and more efficient execution of trades. It also allows for the implementation of complex strategies that would be impractical for humans to manage.

A key advantage of algorithmic trading is its ability to process vast amounts of market data in a fraction of a second. This speed allows for the identification and exploitation of fleeting market opportunities that might otherwise be missed. Furthermore, algorithms can execute trades with precision and consistency, minimizing the impact of emotional biases and impulsive decisions that can often plague human traders. This precision is crucial in high-volume markets, where even small delays can translate into significant losses.

Key Components of Algorithmic Trading Systems

Algorithmic trading systems are complex and often involve several key components. These components work together to form a sophisticated trading engine that can execute trades according to predefined rules. One of the most important components is the data feed, which provides real-time market information. This data is used by the algorithms to identify potential trading opportunities and make decisions.

Another crucial component is the trading logic, which defines the specific rules and strategies that govern the trading process. These rules might include factors like price movements, volume, or market sentiment. The trading logic is the heart of the system, dictating how the algorithm interacts with the market. It also determines the entry and exit points of trades, which are critical to minimizing risk and maximizing profits.

Finally, the execution component is responsible for placing orders and managing the trades. This component typically interacts with brokerage platforms and exchanges to ensure that trades are executed efficiently and effectively. The sophisticated interplay between these components is essential for successful algorithmic trading.

Risk management is another critical component of algorithmic trading systems. The algorithms should be designed with safeguards to limit potential losses. This is frequently achieved through stop-loss orders or other risk mitigation strategies. These measures are vital for protecting the investment capital and ensuring the long-term viability of the trading system.

Popular Algorithmic Trading Strategies

Moving Average Crossover

Moving average crossover strategies are among the most basic and widely used algorithmic trading strategies. These strategies rely on the relative positions of different moving averages to identify potential buy and sell signals. A common implementation involves comparing a shorter-term moving average (e.g., 50-day) to a longer-term moving average (e.g., 200-day). When the shorter-term moving average crosses above the longer-term moving average, it's often interpreted as a bullish signal, potentially prompting a buy order. Conversely, a crossover below suggests a bearish signal and a potential sell order. Careful consideration must be given to the specific timeframes used, as different time horizons can produce varying results. The effectiveness of this strategy depends heavily on the chosen asset and market conditions, and backtesting is crucial to refine parameter settings.

Implementing this strategy requires careful consideration of the chosen asset's historical performance and market volatility. The potential for false signals and whipsaws exists, especially during periods of rapid price fluctuations. Therefore, it's essential to incorporate stop-loss orders to mitigate risk and manage potential losses.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum indicator used to assess the strength and weakness of an asset's price movements. It measures the magnitude of recent price changes to evaluate overbought or oversold conditions. RSI values typically range from 0 to 100, with readings above 70 often interpreted as an overbought condition, potentially signaling a price reversal. Conversely, readings below 30 may indicate an oversold condition, suggesting a potential price rebound. Combining RSI signals with other indicators can enhance the accuracy and effectiveness of the strategy.

Algorithmic trading strategies using RSI often involve placing buy orders when the RSI falls below a certain threshold, suggesting an oversold condition, and sell orders when it rises above a certain threshold, indicating an overbought condition. This approach aims to capitalize on potential price reversals. However, it's essential to remember that RSI is just one indicator, and combining it with other technical analysis tools can significantly improve the strategy's effectiveness.

Volume-Weighted Average Price (VWAP)

The Volume-Weighted Average Price (VWAP) strategy aims to identify the average price of an asset over a specific period, taking into account the volume of trades executed during that period. VWAP strategies often involve placing buy orders when the current price falls below the VWAP and sell orders when the current price rises above it. This strategy assumes that the average price represents a fair value of the asset, and deviations from this average can indicate potential trading opportunities.

Understanding the mechanics of the VWAP is critical for successful implementation. The VWAP can be calculated for different time frames, and choosing the appropriate timeframe is essential for accurate results. Furthermore, factors like market volatility and trading patterns can influence the VWAP, and these factors should be taken into account when analyzing the data. By carefully considering these aspects, traders can use VWAP to identify potential trading opportunities and improve their overall trading performance.

Moving Average Convergence Divergence (MACD)

Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that helps traders identify potential turning points in the market. The MACD is calculated by subtracting a 26-period exponential moving average from a 12-period exponential moving average. A signal line is then created by using a 9-period exponential moving average of the MACD itself. Crossovers between the MACD and its signal line are often used as buy and sell signals. When the MACD crosses above the signal line, it often indicates a bullish trend, and vice versa for a bearish trend.

Proper implementation of a MACD strategy involves a thorough understanding of its interpretation. The MACD can generate a multitude of signals, and traders need to filter these signals effectively to avoid false signals. Backtesting and optimization are crucial to fine-tune the parameters of the MACD strategy for maximum effectiveness in specific market conditions.

Bollinger Bands

Bollinger Bands are a technical analysis tool that measures price volatility and identifies potential trading opportunities. The bands consist of a central moving average and two bands above and below it, typically defined by standard deviations. The bands are used to identify overbought and oversold conditions. When the price moves outside the bands, it may indicate a potential reversal in the trend.

Utilizing Bollinger Bands effectively in an algorithmic trading strategy requires a careful analysis of the chosen asset's historical volatility. The bands' responsiveness to market fluctuations can influence the signals generated. Proper risk management and stop-loss orders are essential when employing Bollinger Bands in trading, as market conditions can change quickly.

Support and Resistance

Support and resistance levels are crucial elements in technical analysis and algorithmic trading strategies. Support levels represent price points where the asset's price is expected to find buyers, potentially preventing further downward movement. Resistance levels, conversely, represent price points where the asset's price might encounter sellers, potentially preventing upward movement.

Identifying these levels requires careful analysis of historical price patterns. These levels can be determined graphically or statistically. Algorithmic trading strategies leveraging support and resistance levels often involve placing buy orders near support levels and sell orders near resistance levels. However, a comprehensive strategy must consider market volatility and other indicators to ensure the accuracy and efficiency of trading decisions based on support and resistance levels.