Streamlining Supply Chain Management: Optimizing Efficiency and Reducing Costs

Optimizing Inventory Management

Effective inventory management is crucial for streamlining supply chain operations. Maintaining optimal stock levels prevents both overstocking, which ties up capital and increases storage costs, and understocking, leading to lost sales and frustrated customers. Implementing inventory forecasting models, based on historical data and predicted demand, can significantly enhance accuracy and reduce waste. This involves analyzing trends, seasonality, and external factors that might impact demand.

Implementing a robust inventory management system, coupled with real-time tracking and visibility, allows for proactive adjustments to stock levels. This proactive approach can significantly reduce the risk of stockouts and ensure that products are available when and where they are needed most.

Improving Supplier Relationships

Strong supplier relationships are fundamental to a successful and resilient supply chain. Building trust and open communication channels with key suppliers facilitates collaboration and information sharing. This mutual understanding helps anticipate potential disruptions and develop contingency plans. Building strong relationships fosters a sense of partnership, encouraging proactive problem-solving and ultimately leading to more efficient and reliable supply chains.

Regular communication, performance reviews, and joint problem-solving sessions are essential elements in maintaining positive and productive relationships with suppliers. These efforts ensure that both parties are aligned towards achieving shared objectives and minimizing disruptions.

Implementing Technology Solutions

Leveraging technology is essential for modern supply chain management. Implementing advanced software solutions for order processing, warehouse management, and transportation optimization can significantly improve efficiency and reduce costs. This includes utilizing tools for real-time tracking of goods, automated inventory management, and predictive analytics for demand forecasting.

Implementing a robust Enterprise Resource Planning (ERP) system can improve visibility across the entire supply chain. This allows for better decision-making, faster response times to changing market conditions, and ultimately, a more agile and responsive supply chain.

Enhancing Logistics and Transportation

Optimizing logistics and transportation networks is vital for cost-effectiveness and timely delivery. Employing strategic transportation methods, considering factors like distance, cost, and delivery time, is crucial for efficient distribution. This includes exploring alternative transportation options and leveraging technology to track shipments and optimize routes.

Using efficient and cost-effective transportation methods, such as multi-modal transportation (combining different modes of transport) and optimized routing algorithms, can significantly reduce transportation costs and improve delivery times. These improvements contribute to a more streamlined and efficient supply chain.

Data Analysis and Reporting

Data analysis plays a crucial role in understanding supply chain performance. Analyzing data from various sources, including inventory levels, order fulfillment times, and supplier performance, allows for identifying bottlenecks and areas for improvement. By monitoring key metrics and trends, businesses can make data-driven decisions to optimize processes and enhance efficiency.

Regular reporting on key supply chain metrics provides transparency and accountability, enabling stakeholders to understand the performance and identify areas needing attention. This fosters a culture of continuous improvement and allows for timely adjustments to strategies.

Risk Management and Contingency Planning

Supply chains are susceptible to various disruptions, from natural disasters to economic downturns. Developing robust risk management strategies and contingency plans is essential for maintaining resilience. This involves identifying potential risks and implementing mitigation strategies to minimize their impact.

Identifying potential disruptions and developing contingency plans are vital for maintaining a resilient supply chain. This proactive approach can protect businesses from significant losses and ensure business continuity during challenging times. Contingency plans should be regularly reviewed and updated to reflect evolving risks and market conditions.

Revolutionizing Financial Processes: Enabling Faster and More Secure Transactions

Streamlining Transaction Processing

Modern financial processes often involve numerous steps and intermediaries, leading to delays and potential vulnerabilities. This inefficiency can impact everything from customer satisfaction to overall business profitability. By leveraging advanced technologies like blockchain and AI, we can automate and optimize these processes, significantly reducing the time required to complete a transaction. This streamlined approach not only benefits individuals but also fosters a more robust and secure financial ecosystem.

Automated clearing houses and real-time payment systems are examples of initiatives that promote faster processing speeds. These advancements eliminate the need for manual intervention at various stages, minimizing errors and significantly reducing processing time. The result is a more responsive and efficient financial system.

Enhanced Security Measures

Security is paramount in the financial world. Protecting sensitive data and ensuring the integrity of transactions is crucial to maintain public trust and prevent fraud. Innovative security protocols, such as multi-factor authentication and advanced encryption techniques, are essential in building a secure financial infrastructure. These measures help safeguard against cyber threats and malicious actors, providing peace of mind for all parties involved in financial transactions.

Improved Transparency and Auditability

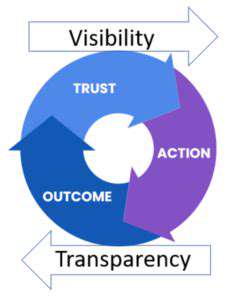

Transparency and auditability are key components of a trustworthy financial system. With the increased use of digital platforms, it's crucial to ensure that all transactions are recorded and accessible for review. Advanced technologies allow for greater traceability, making it easier to identify and rectify any discrepancies or errors. This enhanced transparency not only promotes accountability but also builds confidence in the system.

Robust audit trails, coupled with verifiable transaction records, provide a clear and detailed history of every financial activity. This level of detail allows for effective monitoring, detection of anomalies, and ultimately, a more secure and reliable financial environment.

Empowering Individuals and Businesses

Revolutionizing financial processes translates to a more empowering experience for both individuals and businesses. Simplified transaction flows, faster processing speeds, and greater security create a more user-friendly experience. Individuals can manage their finances with greater ease and efficiency, while businesses can focus on core operations knowing that their transactions are handled securely and swiftly.

This empowerment extends to small businesses, enabling them to access financial services more readily and efficiently. Such accessibility is vital for entrepreneurs and startups, enabling them to scale their operations with confidence.

The Role of Technology in Financial Transformation

Technology plays a central role in driving these changes. From cloud-based platforms to AI-powered fraud detection systems, technology is transforming the landscape of financial processes. Blockchain technology, in particular, offers a secure and transparent way to manage and track transactions, eliminating intermediaries and reducing processing time. The integration of these technologies fosters a more streamlined and secure financial ecosystem.

Global Implications and Future Trends

The revolution in financial processes has global implications. Standardization and interoperability across different financial systems are crucial to ensure seamless transactions across borders and jurisdictions. As technology continues to evolve, we can expect further advancements in areas like decentralized finance (DeFi) and tokenized assets. These innovations will further shape the future of financial transactions and operations.

Future trends indicate an increasing reliance on automation and AI to manage and secure financial processes. This will result in faster transaction times, reduced costs, and increased efficiency, ultimately improving the overall financial experience for everyone.